Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 32

Ratios: Evaluation of Two Companies

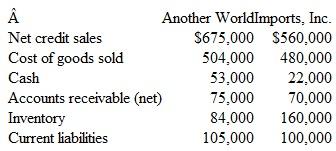

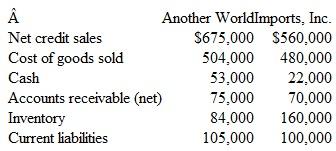

Shown below are selected financial data for Another World and Imports, Inc., at the end of the current year:

Assume that the year-end balances shown for accounts receivable and for inventory approximate the average balances of these items throughout the year.

Instructions

a. For each of the two companies, compute the following:

1. Working capital.

2. Current ratio.

3. Quick ratio.

4. Number of times inventory turned over during the year and the average number of days required to turn over inventory (round computation to the nearest day).

5. Number of times accounts receivable turned over during the year and the average number of days required to collect accounts receivable (round computation to the nearest day).

6. Operating cycle.

b. From the viewpoint of a short-term creditor, comment on the quality of each company's working capital. To which company would you prefer to sell $25,000 in merchandise on a 30-day open account?

Shown below are selected financial data for Another World and Imports, Inc., at the end of the current year:

Assume that the year-end balances shown for accounts receivable and for inventory approximate the average balances of these items throughout the year.

Instructions

a. For each of the two companies, compute the following:

1. Working capital.

2. Current ratio.

3. Quick ratio.

4. Number of times inventory turned over during the year and the average number of days required to turn over inventory (round computation to the nearest day).

5. Number of times accounts receivable turned over during the year and the average number of days required to collect accounts receivable (round computation to the nearest day).

6. Operating cycle.

b. From the viewpoint of a short-term creditor, comment on the quality of each company's working capital. To which company would you prefer to sell $25,000 in merchandise on a 30-day open account?

التوضيح

(a) Computation of ratios:

(a) Working ...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255