Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 24

An Introduction to Product Costs

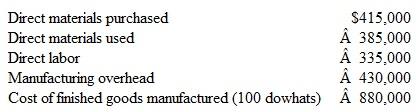

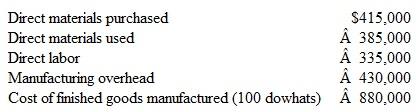

Pinning, Inc., manufactures dowhats. The manufacturing costs incurred during its first year of operations are as follows:

During the year, 110 completed dowhats were manufactured, of which 90 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average'per-unit cost of manufacturing a completed dowhat.)

During the year, 110 completed dowhats were manufactured, of which 90 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average'per-unit cost of manufacturing a completed dowhat.)

Instructions

a. Compute each of the following and show all computations:

1. The average per-unit cost of manufacturing a completed dowhat during the current year.

2. The year-end balances of the following inventories: materials, work in progress, and finished goods.

3. The cost of goods sold during the year.

b. For the current year, the costs of direct materials purchased, direct labor, and manufacturing overhead total $1,180,000. Is this the amount of manufacturing costs deducted from revenue in the current year? Explain fully.

Pinning, Inc., manufactures dowhats. The manufacturing costs incurred during its first year of operations are as follows:

During the year, 110 completed dowhats were manufactured, of which 90 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average'per-unit cost of manufacturing a completed dowhat.)

During the year, 110 completed dowhats were manufactured, of which 90 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average'per-unit cost of manufacturing a completed dowhat.)Instructions

a. Compute each of the following and show all computations:

1. The average per-unit cost of manufacturing a completed dowhat during the current year.

2. The year-end balances of the following inventories: materials, work in progress, and finished goods.

3. The cost of goods sold during the year.

b. For the current year, the costs of direct materials purchased, direct labor, and manufacturing overhead total $1,180,000. Is this the amount of manufacturing costs deducted from revenue in the current year? Explain fully.

التوضيح

2. Calculation of Year-end balances of: ...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255