Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 6

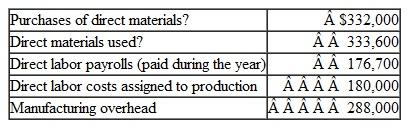

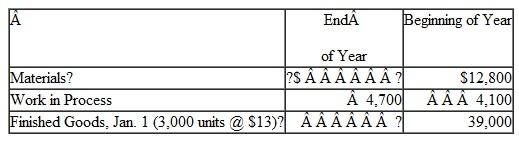

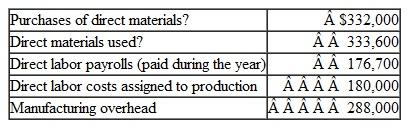

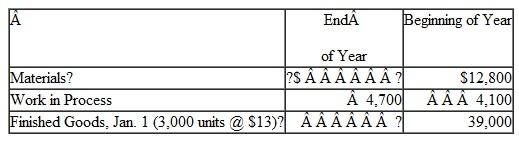

The following are data regarding last year's production of Baby Buddy, one of the major products of Toledo Toy Company:

During the year, 60,000 units of this product were manufactured and 62,100 units were sold. Selected information concerning inventories during the year follows:

During the year, 60,000 units of this product were manufactured and 62,100 units were sold. Selected information concerning inventories during the year follows:

Instructions

Instructions

a. Prepare a schedule of the cost of finished goods manufactured for the Baby Buddy product.

b. Compute the average cost of Baby Buddy per finished unit.

c. Compute the cost of goods sold associated with the sale of Baby Buddy. Assume that there is a first-in, first-out (FIFO) flow through the Finished Goods Inventory account and that all units completed during the year are assigned the per-unit costs determined in part b.

d. Compute the amount of inventory relating to Baby Buddy that will be listed in the company's balance sheet at December 31, Show supporting computations for the year-end amounts of materials inventory and finished goods inventory.

e. Explain how the $180,000 in direct labor costs assigned to production affect the company's income statement and balance sheet.

During the year, 60,000 units of this product were manufactured and 62,100 units were sold. Selected information concerning inventories during the year follows:

During the year, 60,000 units of this product were manufactured and 62,100 units were sold. Selected information concerning inventories during the year follows: Instructions

Instructions a. Prepare a schedule of the cost of finished goods manufactured for the Baby Buddy product.

b. Compute the average cost of Baby Buddy per finished unit.

c. Compute the cost of goods sold associated with the sale of Baby Buddy. Assume that there is a first-in, first-out (FIFO) flow through the Finished Goods Inventory account and that all units completed during the year are assigned the per-unit costs determined in part b.

d. Compute the amount of inventory relating to Baby Buddy that will be listed in the company's balance sheet at December 31, Show supporting computations for the year-end amounts of materials inventory and finished goods inventory.

e. Explain how the $180,000 in direct labor costs assigned to production affect the company's income statement and balance sheet.

التوضيح

Direct Materials:

It is also known as i...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255