Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 10

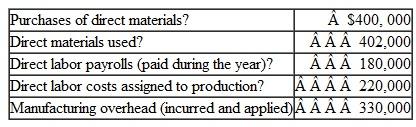

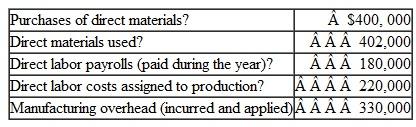

The following are data regarding last year's production of Old Joe, one of the major products of Columbus Toy Company:

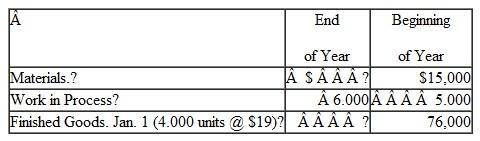

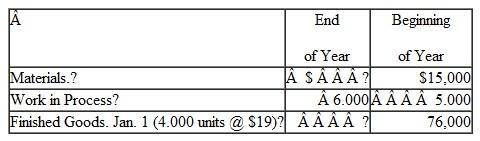

During the year, 50,000 units of this product were manufactured and 51.500 units were sold. Selected information concerning inventories during the year follows:

During the year, 50,000 units of this product were manufactured and 51.500 units were sold. Selected information concerning inventories during the year follows:

Instructions

Instructions

a. Prepare a schedule, of the cost of finished goods manufactured for the Old Joe product.

b. Compute the average cost of Old Joe per finished unit.

c. Compute the cost of goods sold associated with the sale of Old Joe. Assume that there is a first-in. first-out (FIFO) Flow through the Finished Goods Inventory account and that all units completed are assigned the per-unit costs determined in part b.

d. Compute the amount of inventory relating to Old Joe that will be listed in the company's balance sheet at December 31 Show supporting computations for the year-end amounts of materials inventory and finished goods inventory.

e. Explain how the $220,000 in direct labor costs assigned to production affect the company's income statement and balance sheet.

During the year, 50,000 units of this product were manufactured and 51.500 units were sold. Selected information concerning inventories during the year follows:

During the year, 50,000 units of this product were manufactured and 51.500 units were sold. Selected information concerning inventories during the year follows: Instructions

Instructions a. Prepare a schedule, of the cost of finished goods manufactured for the Old Joe product.

b. Compute the average cost of Old Joe per finished unit.

c. Compute the cost of goods sold associated with the sale of Old Joe. Assume that there is a first-in. first-out (FIFO) Flow through the Finished Goods Inventory account and that all units completed are assigned the per-unit costs determined in part b.

d. Compute the amount of inventory relating to Old Joe that will be listed in the company's balance sheet at December 31 Show supporting computations for the year-end amounts of materials inventory and finished goods inventory.

e. Explain how the $220,000 in direct labor costs assigned to production affect the company's income statement and balance sheet.

التوضيح

(a) Preparing the schedule of Cost of fi...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255