Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 30

Determining Unit Costs Using the Cost of Finished Goods Manufactured

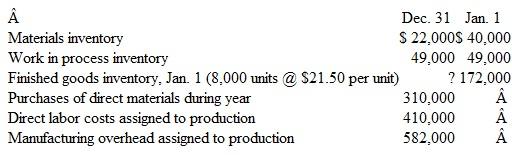

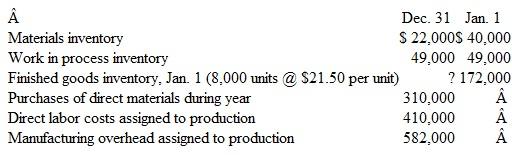

The accounting records of the Cedar Company include the following information relating to the current year:

The company manufactures a single product; during the current year, 60,000 units were manufactured and 50,000 units were sold.

Instructions

a. Prepare a schedule of the cost of finished goods manufactured for the current year. (Show a supporting computation of the cost of direct materials used during the year.)

b. Compute the average per-unit cost of production during the current year. Is the cost higher or lower than last year?

c. Compute the cost of goods sold during the year, assuming that the FIFO (first-in, first-out) method of inventory costing is used.

d. Compute the cost of the inventory of finished goods at December 31 of the current year, assuming that the FIFO (first-in, first-out) method of inventory costing is used.

The accounting records of the Cedar Company include the following information relating to the current year:

The company manufactures a single product; during the current year, 60,000 units were manufactured and 50,000 units were sold.

Instructions

a. Prepare a schedule of the cost of finished goods manufactured for the current year. (Show a supporting computation of the cost of direct materials used during the year.)

b. Compute the average per-unit cost of production during the current year. Is the cost higher or lower than last year?

c. Compute the cost of goods sold during the year, assuming that the FIFO (first-in, first-out) method of inventory costing is used.

d. Compute the cost of the inventory of finished goods at December 31 of the current year, assuming that the FIFO (first-in, first-out) method of inventory costing is used.

التوضيح

a.

Prepare a schedule for the cost of f...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255