Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 1

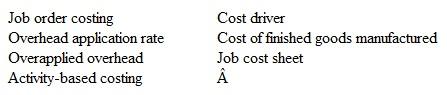

Listed below are seven technical accounting terms introduced or emphasized in this chapter.

Each of the following statements may (or may not) describe these technical terms. For each statement, indicate the term described, or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not) describe these technical terms. For each statement, indicate the term described, or answer "None" if the statement does not correctly describe any of the terms.

a. An activity base that can be traced directly to units produced and can be used as a denominator in computing an overhead application rate.

b. The total of all direct labor, direct materials, and manufacturing overhead transferred from work in process to finished goods.

c. A means of assigning indirect product costs to work in process during the period.

d. A debit balance remaining in the Manufacturing Overhead account at the end of the period.

e. The type of cost accounting system likely to be used by a construction company.

f. The type of cost accounting method likely to be used for overhead costs.

Each of the following statements may (or may not) describe these technical terms. For each statement, indicate the term described, or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not) describe these technical terms. For each statement, indicate the term described, or answer "None" if the statement does not correctly describe any of the terms.a. An activity base that can be traced directly to units produced and can be used as a denominator in computing an overhead application rate.

b. The total of all direct labor, direct materials, and manufacturing overhead transferred from work in process to finished goods.

c. A means of assigning indirect product costs to work in process during the period.

d. A debit balance remaining in the Manufacturing Overhead account at the end of the period.

e. The type of cost accounting system likely to be used by a construction company.

f. The type of cost accounting method likely to be used for overhead costs.

التوضيح

(a) An activity base that can be traced ...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255