Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 9

Job Order Costing: Computations and Journal Entries

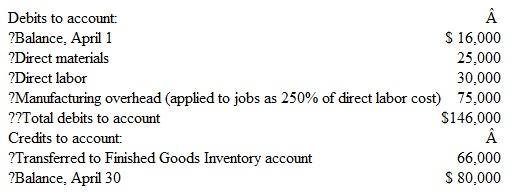

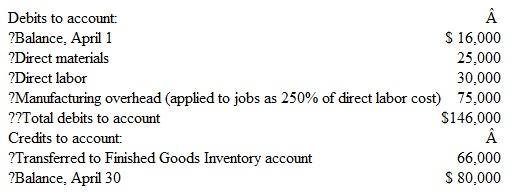

Winona Enterprises uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs. The following information appears in the company's Work in Process Inventory account for the month of April:

Instructions

a. Assuming that the direct labor charged to the jobs still in process at April 30 amounts to $18,000, compute the amount of manufacturing overhead and the amount of direct materials that have been charged to these jobs as of April 30.

b. Prepare general journal entries to summarize:

1. The manufacturing costs (direct materials, direct labor, and overhead) charged to production during April.

2. The transfer of production completed during April to the Finished Goods Inventory account.

3. The cash sale of 70 percent of the merchandise completed during April at a total sales price of $98,000. Show the related cost of goods sold in a separate journal entry.

Winona Enterprises uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs. The following information appears in the company's Work in Process Inventory account for the month of April:

Instructions

a. Assuming that the direct labor charged to the jobs still in process at April 30 amounts to $18,000, compute the amount of manufacturing overhead and the amount of direct materials that have been charged to these jobs as of April 30.

b. Prepare general journal entries to summarize:

1. The manufacturing costs (direct materials, direct labor, and overhead) charged to production during April.

2. The transfer of production completed during April to the Finished Goods Inventory account.

3. The cash sale of 70 percent of the merchandise completed during April at a total sales price of $98,000. Show the related cost of goods sold in a separate journal entry.

التوضيح

(a)

The ending balance in the work-in-pr...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255