Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 14

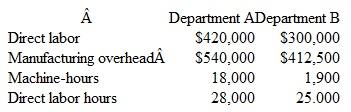

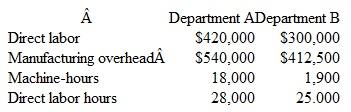

Precision Instruments. Inc., uses job order costing and applies manufacturing overhead to individual jobs by using predetermined overhead rates. In Department A, overhead is applied on the basis of machine-hours, and in Department B. on the basis of direct labor hours. At the beginning of the current year, management made the following budget estimates as a step toward determining the overhead application rates:

Production of 4.000 tachometers ( job no. 399) was started in the middle of January and completed two weeks later. The cost records for this job show the following information:

Production of 4.000 tachometers ( job no. 399) was started in the middle of January and completed two weeks later. The cost records for this job show the following information:

Instructions

Instructions

a. Determine the overhead rate that should be used for each department in applying overhead costs to job no. 399.

b. What is the total cost of job no. 399, and what is the unit cost of the product manufactured on this production order?

c. Prepare the journal entries required to record the sale (oil account) of 1.000 of the tachometers to SkiCraft Boats. The total sales price was $19,500.

d. Assume that actual overhead costs for the year were $517,000 in Department A and $424,400 in Department B. Actual machine-hours in Department A were 17,000, and actual direct labor hours in Department B were 26,000 during the year. On the basis of this information, determine the over- or underapplied overhead in each department for the year.

Production of 4.000 tachometers ( job no. 399) was started in the middle of January and completed two weeks later. The cost records for this job show the following information:

Production of 4.000 tachometers ( job no. 399) was started in the middle of January and completed two weeks later. The cost records for this job show the following information: Instructions

Instructions a. Determine the overhead rate that should be used for each department in applying overhead costs to job no. 399.

b. What is the total cost of job no. 399, and what is the unit cost of the product manufactured on this production order?

c. Prepare the journal entries required to record the sale (oil account) of 1.000 of the tachometers to SkiCraft Boats. The total sales price was $19,500.

d. Assume that actual overhead costs for the year were $517,000 in Department A and $424,400 in Department B. Actual machine-hours in Department A were 17,000, and actual direct labor hours in Department B were 26,000 during the year. On the basis of this information, determine the over- or underapplied overhead in each department for the year.

التوضيح

Job order Costing

• It is a method of c...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255