Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 20

Determining Balance Sheet Amounts from Job Sheets

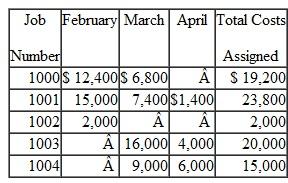

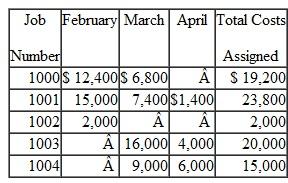

Robinson International began operations inearly February. The company has provided thefollowingsummary of total manufacturing costs assigned to the jobsheets of itsentire client base during itsfirst three months of operations:

Job no. 1002 was completed in February and sold in March. Job no. 1000 was completed and sold in March. Job no. 1001 was completed and sold in April. Job no.1003 was completed in April, but won't bedelivered until early May. Only job no. 1004 remains in process at April 30. The selling prices are set at 175 percent of the manufacturing costs assigned to each job.

Job no. 1002 was completed in February and sold in March. Job no. 1000 was completed and sold in March. Job no. 1001 was completed and sold in April. Job no.1003 was completed in April, but won't bedelivered until early May. Only job no. 1004 remains in process at April 30. The selling prices are set at 175 percent of the manufacturing costs assigned to each job.

a. Determine the Work in Process Inventory balance at the end of February, March, and April.

b. Determine the Finished Goods Inventory balance at the end of February, March, and April.

c. Compute the company's total gross profit for the three months ended April 30.

Robinson International began operations inearly February. The company has provided thefollowingsummary of total manufacturing costs assigned to the jobsheets of itsentire client base during itsfirst three months of operations:

Job no. 1002 was completed in February and sold in March. Job no. 1000 was completed and sold in March. Job no. 1001 was completed and sold in April. Job no.1003 was completed in April, but won't bedelivered until early May. Only job no. 1004 remains in process at April 30. The selling prices are set at 175 percent of the manufacturing costs assigned to each job.

Job no. 1002 was completed in February and sold in March. Job no. 1000 was completed and sold in March. Job no. 1001 was completed and sold in April. Job no.1003 was completed in April, but won't bedelivered until early May. Only job no. 1004 remains in process at April 30. The selling prices are set at 175 percent of the manufacturing costs assigned to each job.a. Determine the Work in Process Inventory balance at the end of February, March, and April.

b. Determine the Finished Goods Inventory balance at the end of February, March, and April.

c. Compute the company's total gross profit for the three months ended April 30.

التوضيح

(a) Determination of the Work-In-Process...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255