Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 25

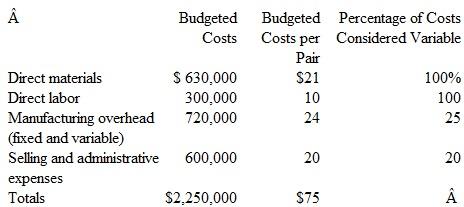

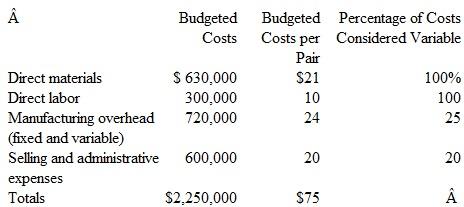

Blaster Corporation manufactures hiking boots. For the coming year, the company has budgeted the following costs for the production and sale of 30,000 pairs of boots:

Instructions

Instructions

a. Compute the sales price per unit that would result in a budgeted operating income of $900,000. assuming that the company produces and sells 30,000 pairs. (Hint: First compute the budgeted sales revenue needed to produce this operating income.)

b. Assuming that the company decides to sell the boots at a unit price of $ 121 per pair, compute the following:

1. Total fixed costs budgeted for the year.

2. Variable cost per unit.

3. The unit contribution margin.

4. The number of pairs that must be produced and sold annually to break even at a sales price of $121 per pair.

Instructions

Instructions a. Compute the sales price per unit that would result in a budgeted operating income of $900,000. assuming that the company produces and sells 30,000 pairs. (Hint: First compute the budgeted sales revenue needed to produce this operating income.)

b. Assuming that the company decides to sell the boots at a unit price of $ 121 per pair, compute the following:

1. Total fixed costs budgeted for the year.

2. Variable cost per unit.

3. The unit contribution margin.

4. The number of pairs that must be produced and sold annually to break even at a sales price of $121 per pair.

التوضيح

Fixed cost

Total cost

Total variab...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255