Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 10

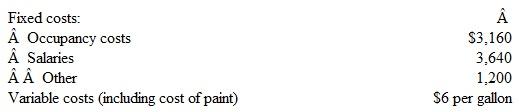

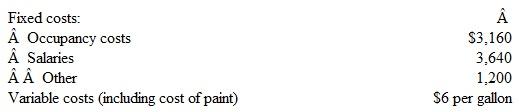

Rainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an independent paint manufacturer. Guy Walker, president of Rainbow Paints, is studying the advisability of opening another store. His estimates of monthly costs for the proposed location are:

Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold.

Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold.

Instructions

a. Compute the contribution margin ratio and the break-even point in dollar sales and in gallons sold for the proposed store.

b. Draw a monthly cost-volume-profit graph for the proposed store, assuming 3,000 gallons per month as the maximum sales potential.

c. Walker thinks that the proposed store will sell between 2,200 and 2,600 gallons of paint per month. Compute the amount of operating income that would be earned per month at each of these sales volumes.

Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold.

Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold.Instructions

a. Compute the contribution margin ratio and the break-even point in dollar sales and in gallons sold for the proposed store.

b. Draw a monthly cost-volume-profit graph for the proposed store, assuming 3,000 gallons per month as the maximum sales potential.

c. Walker thinks that the proposed store will sell between 2,200 and 2,600 gallons of paint per month. Compute the amount of operating income that would be earned per month at each of these sales volumes.

التوضيح

Unit variable cost

$ 6 per gallon

Un...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255