Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 31

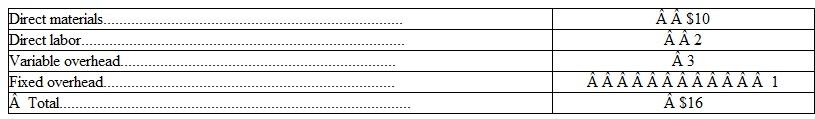

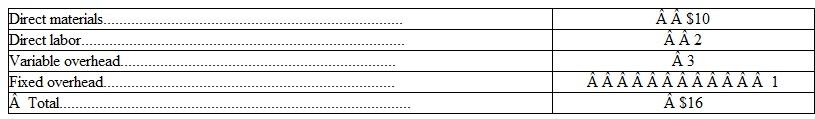

Silent Sentry manufactures gas leak detectors that are sold to homeowners throughout the United States at $25 apiece. Each detector is equipped with a sensory cell that is guaranteed to last two full years before needing to be replaced. The company currently has 50,000 gas leak detectors in its inventory that contain sensory cells that had been purchased from a discount vendor. Silent Sentry engineers estimate that these sensory cells will last only 18 months before needing to be replaced. The company has incurred the following unit costs related to the 50,000 detectors:

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:

1. Scrap the inferior sensory cell in each unit and replace it with a new one at a cost of $8 each. The units could then be sold at their full unit price of $25.

2. Sell the units with the inferior sensory cells at a discounted unit price of $24. This option would also involve changing the packaging of each unit to inform the buyer that the estimated life of the sensory cell is 18 months. The estimated out-of-pocket cost associated with the packaging changes is $3 per unit.

3. Sell each unit "as is" with its current packaging to a discount buyer in a foreign country. The buyer has offered to pay Silent Sentry a unit price of $22.

Instructions

a. Perform an incremental analysis of these options. Based on the analysis, which option should Silent Sentry choose?

b. What nonfinancial concerns should the company take into consideration?

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:1. Scrap the inferior sensory cell in each unit and replace it with a new one at a cost of $8 each. The units could then be sold at their full unit price of $25.

2. Sell the units with the inferior sensory cells at a discounted unit price of $24. This option would also involve changing the packaging of each unit to inform the buyer that the estimated life of the sensory cell is 18 months. The estimated out-of-pocket cost associated with the packaging changes is $3 per unit.

3. Sell each unit "as is" with its current packaging to a discount buyer in a foreign country. The buyer has offered to pay Silent Sentry a unit price of $22.

Instructions

a. Perform an incremental analysis of these options. Based on the analysis, which option should Silent Sentry choose?

b. What nonfinancial concerns should the company take into consideration?

التوضيح

(a) Incremental analysis for 50,000 old ...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255