Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 25

Estimating Borrowing Requirements

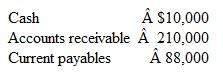

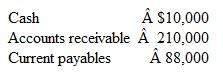

Former Corporation sells office supplies to government agencies. At the beginning of the current quarter, the company reports the following selected account balances:

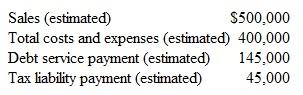

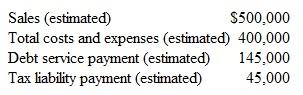

Former's management has made the following budget estimates regarding operations for the current quarter:

Former's management has made the following budget estimates regarding operations for the current quarter:

Of Former's total costs and expenses, $20,000 is quarterly depreciation expense, and $20,000 represents the expiration of prepayments. The remaining $360,000 is to be financed with current payables. The company's ending prepayments balance is expected to be the same as its beginning prepayments balance. Its ending current payables balance is expected to be $22,000 more than its beginning balance.

Of Former's total costs and expenses, $20,000 is quarterly depreciation expense, and $20,000 represents the expiration of prepayments. The remaining $360,000 is to be financed with current payables. The company's ending prepayments balance is expected to be the same as its beginning prepayments balance. Its ending current payables balance is expected to be $22,000 more than its beginning balance.

All of Former's sales are on account. Approximately 65 percent of its sales are collected in the quarter in which they are made. The remaining 35 percent are collected in the following quarter. Because all of the company's sales are made to government agencies, it experiences virtually no uncollectible accounts.

Former's minimum cash balance requirement is $10,000. Should the balance fall below this amount, management negotiates a short-term loan with a local bank. The company's debt ratio (liabilities ÷ assets) is currently 80percent.

Instructions

a. Compute Former's budgeted cash receipts for the quarter.

b. Compute Former's payments of current payables budgeted for the quarter.

c. Compute Former's cash prepayments budgeted for the quarter.

d. Prepare Former's cash budget for the quarter.

e. Estimate Former's short-term borrowing requirements for the quarter.

f. Discuss problems Former might encounter in obtaining short-term financing.

Former Corporation sells office supplies to government agencies. At the beginning of the current quarter, the company reports the following selected account balances:

Former's management has made the following budget estimates regarding operations for the current quarter:

Former's management has made the following budget estimates regarding operations for the current quarter: Of Former's total costs and expenses, $20,000 is quarterly depreciation expense, and $20,000 represents the expiration of prepayments. The remaining $360,000 is to be financed with current payables. The company's ending prepayments balance is expected to be the same as its beginning prepayments balance. Its ending current payables balance is expected to be $22,000 more than its beginning balance.

Of Former's total costs and expenses, $20,000 is quarterly depreciation expense, and $20,000 represents the expiration of prepayments. The remaining $360,000 is to be financed with current payables. The company's ending prepayments balance is expected to be the same as its beginning prepayments balance. Its ending current payables balance is expected to be $22,000 more than its beginning balance.All of Former's sales are on account. Approximately 65 percent of its sales are collected in the quarter in which they are made. The remaining 35 percent are collected in the following quarter. Because all of the company's sales are made to government agencies, it experiences virtually no uncollectible accounts.

Former's minimum cash balance requirement is $10,000. Should the balance fall below this amount, management negotiates a short-term loan with a local bank. The company's debt ratio (liabilities ÷ assets) is currently 80percent.

Instructions

a. Compute Former's budgeted cash receipts for the quarter.

b. Compute Former's payments of current payables budgeted for the quarter.

c. Compute Former's cash prepayments budgeted for the quarter.

d. Prepare Former's cash budget for the quarter.

e. Estimate Former's short-term borrowing requirements for the quarter.

f. Discuss problems Former might encounter in obtaining short-term financing.

التوضيح

(a) Computation of budgeted cash receipt...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255