Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 14

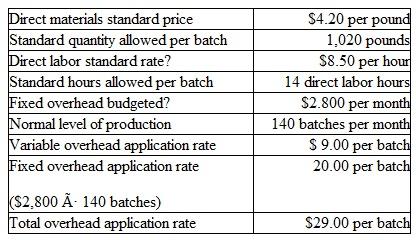

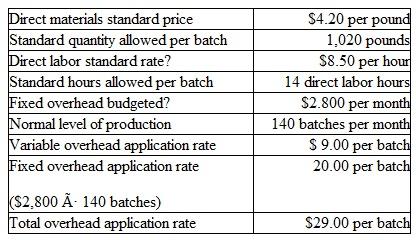

Sven Enterprises is a large producer of gourmet pet food. During April, it produced 147 batches of puppy meal. Each batch weighs 1,000 pounds. To produce this quantity of output, the company purchased and used 148,450 pounds of direct materials at a cost of $593,800. it also incurred direct labor costs of $17,600 for the 2,200 hours worked by employees on the puppy meal crew. Manufacturing overhead incurred at the puppy meal plant during April totaled $3,625. of which $2,450 was considered fixed. Sven's standard cost information for 1,000-pound batches of puppy meal is as follows:

Instructions

Instructions

a. Compute the materials price and quantity variances.

b. Compute the labor rate and efficiency variances.

c. Compute the manufacturing overhead spending and volume variances.

d. Record the journal entry to charge materials (at standard) to Work in Process.

e. Record the journal entry to charge direct labor (at standard) to Work in Process.

f. Record the journal entry to charge manufacturing overhead (at standard) to Work in Process.

g. Record the journal entry to transfer the 147 batches of puppy meal produced in April to Finished Goods.

h. Record the journal entry to close any over-or underapplied overhead to Cost of Goods Sold.

Instructions

Instructions a. Compute the materials price and quantity variances.

b. Compute the labor rate and efficiency variances.

c. Compute the manufacturing overhead spending and volume variances.

d. Record the journal entry to charge materials (at standard) to Work in Process.

e. Record the journal entry to charge direct labor (at standard) to Work in Process.

f. Record the journal entry to charge manufacturing overhead (at standard) to Work in Process.

g. Record the journal entry to transfer the 147 batches of puppy meal produced in April to Finished Goods.

h. Record the journal entry to close any over-or underapplied overhead to Cost of Goods Sold.

التوضيح

a.

Calculate direct material price vari...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255