Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 52

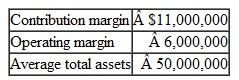

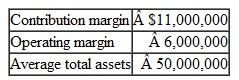

Wolfe Computer manufactures computers and peripheral equipment. The following data relate to Wolfe's Printer Division for the year just ended:

The Printer Division is evaluated as an investment center. Wolfe expects all of its investment centers to earn a minimum annual return of 10 percent on average invested capital. Division managers receive a bonus equal to 1 percent of their division's residual income.

The Printer Division is evaluated as an investment center. Wolfe expects all of its investment centers to earn a minimum annual return of 10 percent on average invested capital. Division managers receive a bonus equal to 1 percent of their division's residual income.

The Printer Division's most popular product is a color printer called the XLC. The division has the capacity to manufacture 30.000 XLCs per year, at a manufacturing cost of $100 per unit. Last year it produced XLCs at full capacity: 25,000 of these printers were sold to independent computer stores for $250 per unit, and the other 5,000 were transferred to Wolfe's Mail-Order Division, which sells them for $300 per unit. Transfers of inventory among units of Wolfe Computer are recorded in the company's accounting records at cost.

As Wolfe's new controller, you are attending a planning meeting of division managers. Kay Green, manager of the Mail-Order Division, has asked for 15,000 XLCs in the coming year. She states. "Net income will increase if the Mail-Order Division sells more XLCs. After all. we get the highest sales price."

David Lee. manager of the Printer Division, replies. "Sorry Kay. we can't do that. Just look at last year-if we'd supplied you with 15.000 XLCs. we wouldn't have made minimum ROL"

Instructions

a. Compute the Printer Division's ROI and residual income based on last year's data.

b. Evaluate the statements made by Green and Lee. (Show how supplying 15.000 XLCs to Mail- Order would have affected the Printer Division's ROI for last year.)

c. Offer suggestions to resolve this situation. Show how your suggestions would have affected the Printer Division's results last year if they had been in effect then.

d. Do you think that your comments in part c might raise an ethical dilemma to be resolved by Wolfe's top management? If so,explain the nature of this potential problem and your personal recommendations about how to resolve it. (Hint: Expect to hear from Lee before the day is over.)

The Printer Division is evaluated as an investment center. Wolfe expects all of its investment centers to earn a minimum annual return of 10 percent on average invested capital. Division managers receive a bonus equal to 1 percent of their division's residual income.

The Printer Division is evaluated as an investment center. Wolfe expects all of its investment centers to earn a minimum annual return of 10 percent on average invested capital. Division managers receive a bonus equal to 1 percent of their division's residual income.The Printer Division's most popular product is a color printer called the XLC. The division has the capacity to manufacture 30.000 XLCs per year, at a manufacturing cost of $100 per unit. Last year it produced XLCs at full capacity: 25,000 of these printers were sold to independent computer stores for $250 per unit, and the other 5,000 were transferred to Wolfe's Mail-Order Division, which sells them for $300 per unit. Transfers of inventory among units of Wolfe Computer are recorded in the company's accounting records at cost.

As Wolfe's new controller, you are attending a planning meeting of division managers. Kay Green, manager of the Mail-Order Division, has asked for 15,000 XLCs in the coming year. She states. "Net income will increase if the Mail-Order Division sells more XLCs. After all. we get the highest sales price."

David Lee. manager of the Printer Division, replies. "Sorry Kay. we can't do that. Just look at last year-if we'd supplied you with 15.000 XLCs. we wouldn't have made minimum ROL"

Instructions

a. Compute the Printer Division's ROI and residual income based on last year's data.

b. Evaluate the statements made by Green and Lee. (Show how supplying 15.000 XLCs to Mail- Order would have affected the Printer Division's ROI for last year.)

c. Offer suggestions to resolve this situation. Show how your suggestions would have affected the Printer Division's results last year if they had been in effect then.

d. Do you think that your comments in part c might raise an ethical dilemma to be resolved by Wolfe's top management? If so,explain the nature of this potential problem and your personal recommendations about how to resolve it. (Hint: Expect to hear from Lee before the day is over.)

التوضيح

a. ROI = 12% ($6,000,000 ÷ $50,000,000)

...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255