Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 26

Performance and ROI versus Residual Income

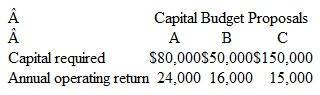

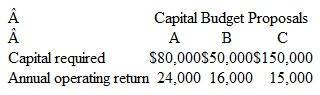

An investment center in Shellforth Corporation was asked to identify three proposals for its capital budget. Details of those proposals are:

Capital Budget Proposals

Shellforth uses residual income to evaluate all capital budgeting projects. Its minimum required return is 12 percent.

a. Assume you are the investment center manager. Which project do you prefer? Why?

b. Assume your investment center's current ROI is 18 percent and that the president of Shellforth is thinking about using ROI for the investment center's evaluation. Would your preferences for the projects listed above change? Why?

An investment center in Shellforth Corporation was asked to identify three proposals for its capital budget. Details of those proposals are:

Capital Budget Proposals

Shellforth uses residual income to evaluate all capital budgeting projects. Its minimum required return is 12 percent.

a. Assume you are the investment center manager. Which project do you prefer? Why?

b. Assume your investment center's current ROI is 18 percent and that the president of Shellforth is thinking about using ROI for the investment center's evaluation. Would your preferences for the projects listed above change? Why?

التوضيح

Information relating to capital budget p...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255