Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 34

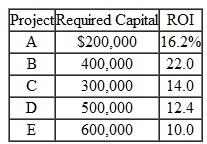

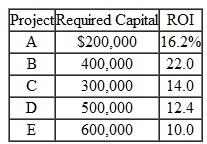

Joe Teller is the manager of one location of the Big Deal Inc. chain. Teller's location is currently earning an ROI of 1.5 percent on existing average capital of $800,000. The minimum required return for Big Deal Inc. is 12 percent. Teller is considering several additional investment projects, which are independent of existing operations and are independent of each other. The following table lists the projects:

Instructions

Instructions

a. Which of the above projects would Teller choose for investment if his objective were to maximize his location's ROI?,

b. Which projects increase the value of Big Deal Inc.?

c. Which projects have a negative residual, income?

d. Create two.rankings for the projects in the order of acceptability if Teller is evaluated (1) on ROI and (2) on residual income.

e. What are the components of ROI? Explain how the combination of components is useful in evaluating the success of business processes within a firm.

Instructions

Instructions a. Which of the above projects would Teller choose for investment if his objective were to maximize his location's ROI?,

b. Which projects increase the value of Big Deal Inc.?

c. Which projects have a negative residual, income?

d. Create two.rankings for the projects in the order of acceptability if Teller is evaluated (1) on ROI and (2) on residual income.

e. What are the components of ROI? Explain how the combination of components is useful in evaluating the success of business processes within a firm.

التوضيح

b. All projects with an ROI above the mi...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255