Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

النسخة 17الرقم المعياري الدولي: 978-0078025778 تمرين 47

Radon Industries produces large earth-moving equipment. The company expanded vertically several years ago by acquiring Boris Steel Company, one of its suppliers. Radon decided to maintain Boris's separate identity and therefore established the Boris Steel Division as one of its investment centers.

Radon evaluates its divisions on the basis of ROI. Management bonuses are also based on ROI. All investments in operating assets are expected to earn a minimum required rate of return of 11 percent.

Boris's ROI has ranged from 14 percent to 17 percent since it was acquired by Radon. During the past year. Boris had an investment opportunity that would have yielded an estimated rate of return of 13 percent. Boris's management decided against the investment because it believed the investment would decrease the division's overall ROI.

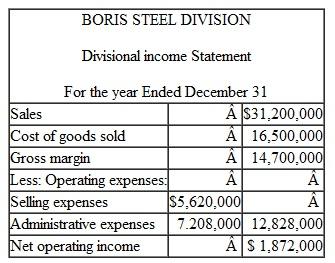

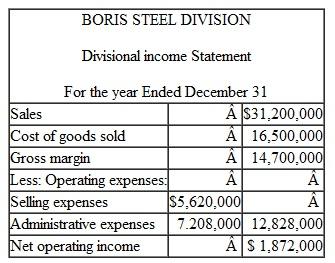

Last year's income statement for the Boris Steel Division is given below. The division's operating assets employed were $12,960,000 at the end of the year, which represents an 8 percent increase over the previous year-end balance.

Last year's income statement for the Boris Steel Division is given below. The division's operating assets employed were $12,960,000 at the end of the year, which represents an 8 percent increase over the previous year-end balance.

Instructions

1. Compute the following performance measures for the Boris Steel Division:

a. ROI where the investment base is the average operating assets (based on the beginning of the year plus the end of the year assets) divided by two. Break ROI into both capital turnover and return on sales.

b. Residual income.

2. Would management of the Boris Steel Division have been more likely to accept the investment opportunity it had last year if residual income were used as a performance measure instead of ROI? Explain your answer.

3. The Boris Steel Division is a separate investment center within Radon Industries. Identify the items Boris must be free to control if it is to be evaluated fairly by either the ROI or the residual income performance measures.

(CMA. adapted)

Radon evaluates its divisions on the basis of ROI. Management bonuses are also based on ROI. All investments in operating assets are expected to earn a minimum required rate of return of 11 percent.

Boris's ROI has ranged from 14 percent to 17 percent since it was acquired by Radon. During the past year. Boris had an investment opportunity that would have yielded an estimated rate of return of 13 percent. Boris's management decided against the investment because it believed the investment would decrease the division's overall ROI.

Last year's income statement for the Boris Steel Division is given below. The division's operating assets employed were $12,960,000 at the end of the year, which represents an 8 percent increase over the previous year-end balance.

Last year's income statement for the Boris Steel Division is given below. The division's operating assets employed were $12,960,000 at the end of the year, which represents an 8 percent increase over the previous year-end balance.Instructions

1. Compute the following performance measures for the Boris Steel Division:

a. ROI where the investment base is the average operating assets (based on the beginning of the year plus the end of the year assets) divided by two. Break ROI into both capital turnover and return on sales.

b. Residual income.

2. Would management of the Boris Steel Division have been more likely to accept the investment opportunity it had last year if residual income were used as a performance measure instead of ROI? Explain your answer.

3. The Boris Steel Division is a separate investment center within Radon Industries. Identify the items Boris must be free to control if it is to be evaluated fairly by either the ROI or the residual income performance measures.

(CMA. adapted)

التوضيح

Return on investment:

Return on investm...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255