Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

النسخة 2الرقم المعياري الدولي: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

النسخة 2الرقم المعياري الدولي: 978-1111824402 تمرين 19

Variable Costs, Contribution Margin, Contribution Margin Ratio

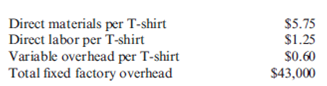

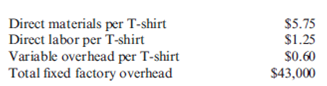

Super-Tees Company plans to sell 12,000 T-shirts at $16 each in the coming year. Product costs include:

Variable selling expense is the redemption of a coupon, which averages $0.80 per T-shirt; fixed selling and administrative expenses total $19,000.

Required:

1. Calculate the:

a. Variable product cost per unit

b. Total variable cost per unit

c. Contribution margin per unit

d. Contribution margin ratio (rounded to four significant digits)

e. Total fixed expense for the year

2. Prepare a contribution-margin-based income statement for Super-Tees Company for the coming year.

3. What if the per unit selling expense increased from $0.80 to $1.75? Calculate the new values for the following:

a. Variable product cost per unit

b. Total variable cost per unit

c. Contribution margin per unit

d. Contribution margin ratio (rounded to four significant digits)

e. Total fixed expense for the year

Super-Tees Company plans to sell 12,000 T-shirts at $16 each in the coming year. Product costs include:

Variable selling expense is the redemption of a coupon, which averages $0.80 per T-shirt; fixed selling and administrative expenses total $19,000.

Required:

1. Calculate the:

a. Variable product cost per unit

b. Total variable cost per unit

c. Contribution margin per unit

d. Contribution margin ratio (rounded to four significant digits)

e. Total fixed expense for the year

2. Prepare a contribution-margin-based income statement for Super-Tees Company for the coming year.

3. What if the per unit selling expense increased from $0.80 to $1.75? Calculate the new values for the following:

a. Variable product cost per unit

b. Total variable cost per unit

c. Contribution margin per unit

d. Contribution margin ratio (rounded to four significant digits)

e. Total fixed expense for the year

التوضيح

In this solution we are required to calc...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255