Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

النسخة 2الرقم المعياري الدولي: 978-1111824402

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

النسخة 2الرقم المعياري الدولي: 978-1111824402 تمرين 44

Discount Rates, Quality, Market Share, Contemporary Manufacturing Environment

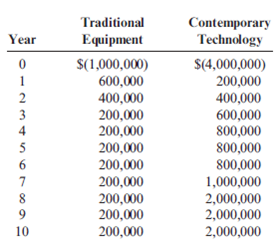

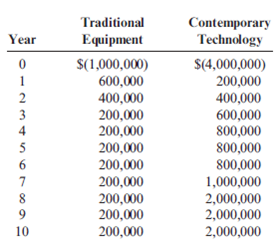

Sweeney Manufacturing has a plant where the equipment is essentially worn out. The equipment must be replaced, and Sweeney is considering two competing investment alternatives. The first alternative would replace the worn-out equipment with traditional production equipment; the second alternative uses contemporary technology and has computer-aided design and manufacturing capabilities. The investment and after-tax operating cash flows for each alternative are as follows:

The company uses a discount rate of 18 percent for all of its investments. The company's cost of capital is 14 percent.

Required:

1. Calculate the net present value for each investment using a discount rate of 18 percent.

2. Calculate the net present value for each investment using a discount rate of 14 percent.

3. Which rate should the company use to compute the net present value? Explain.

4. Now, assume that if the traditional equipment is purchased, the competitive position of the firm will deteriorate because of lower quality (relative to competitors who did automate). Marketing estimates that the loss in market share will decrease the projected net cash inflows by 50 percent for Years 3-10. Recalculate the NPV of the traditional equipment given this outcome. What is the decision now? Discuss the importance of assessing the effect of intangible and indirect benefits.

Sweeney Manufacturing has a plant where the equipment is essentially worn out. The equipment must be replaced, and Sweeney is considering two competing investment alternatives. The first alternative would replace the worn-out equipment with traditional production equipment; the second alternative uses contemporary technology and has computer-aided design and manufacturing capabilities. The investment and after-tax operating cash flows for each alternative are as follows:

The company uses a discount rate of 18 percent for all of its investments. The company's cost of capital is 14 percent.

Required:

1. Calculate the net present value for each investment using a discount rate of 18 percent.

2. Calculate the net present value for each investment using a discount rate of 14 percent.

3. Which rate should the company use to compute the net present value? Explain.

4. Now, assume that if the traditional equipment is purchased, the competitive position of the firm will deteriorate because of lower quality (relative to competitors who did automate). Marketing estimates that the loss in market share will decrease the projected net cash inflows by 50 percent for Years 3-10. Recalculate the NPV of the traditional equipment given this outcome. What is the decision now? Discuss the importance of assessing the effect of intangible and indirect benefits.

التوضيح

1.Calculate NPV using a discount rate of...

Cornerstones of Cost Management 2nd Edition by Don Hansen ,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255