Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

النسخة 15الرقم المعياري الدولي: 978-0073377353

Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

النسخة 15الرقم المعياري الدولي: 978-0073377353 تمرين 1

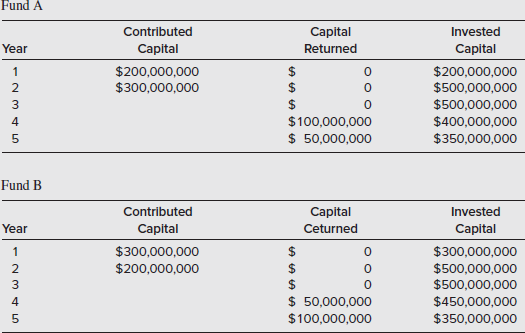

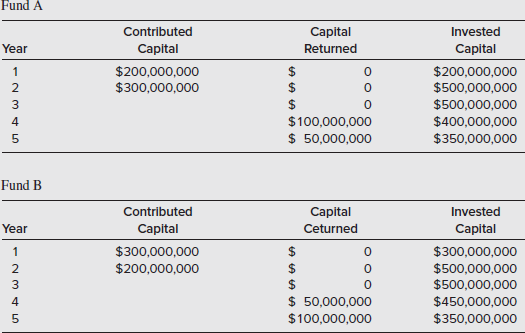

An institutional investor is comparing management fees for two competing real estate investment funds. Both funds expect to begin operations and are accepting capital commitments. When the funds begin acquiring properties, capital call will be made to investors for capital contributions during the investment period. Fund A will charge a fee of 45 BP on capital committed and 60 BP on capital invested after the investment period ends. Fund B will charge a fee of 50 BP on capital committed and 55 BP on capital invested after the investment period ends. Both funds expect to have $500,000,000 in capital commitments and project a five-year cycle for startup and acquisitions. Capital flows are expected as follows:

a. What will total fees be for Fund (A) For Fund (B)

b. What may the pattern of capital commitments/contributions indicate about the expectations of the respective fund managers

a. What will total fees be for Fund (A) For Fund (B)

b. What may the pattern of capital commitments/contributions indicate about the expectations of the respective fund managers

التوضيح

Management fees:

Generally fund is rais...

Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255