Introduction to Management Science 12th Edition by Bernard Taylor

النسخة 12الرقم المعياري الدولي: 978-0133778847

Introduction to Management Science 12th Edition by Bernard Taylor

النسخة 12الرقم المعياري الدولي: 978-0133778847 تمرين 18

In Problems 1 and 2, Ann Tyler is considering hiring a financial analyst to help her determine the best investment. What is the maximum amount she should pay an analyst

Problem 1

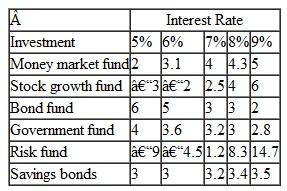

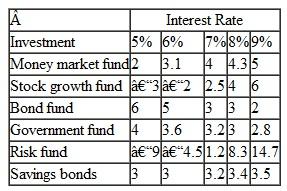

Ann Tyler has come into an inheritance from her grandparents. She is attempting to decide among several investment alternatives. The return after 1 year is primarily dependent on the interest rate during the next year. The rate is currently 7%, and Ann anticipates that it will stay the same or go up or down by at most two points. The various investment alternatives plus their returns ($10,000s), given the interest rate changes, are shown in the following table:

Determine the best investment, using the following decision criteria.

Determine the best investment, using the following decision criteria.

a. Maximax

b. Maximin

c. Equal likelihood

Problem 2

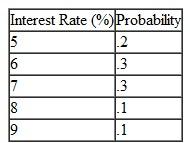

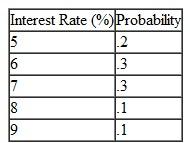

In Problem, Ann Tyler, with the help of a financial newsletter and some library research, has been able to assign probabilities to each of the possible interest rates during the next year, as follows:

Using expected value, determine her best investment decision.

Using expected value, determine her best investment decision.

Problem

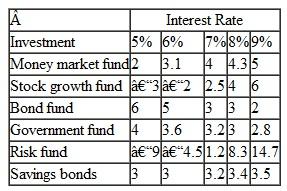

Ann Tyler has come into an inheritance from her grandparents. She is attempting to decide among several investment alternatives. The return after 1 year is primarily dependent on the interest rate during the next year. The rate is currently 7%, and Ann anticipates that it will stay the same or go up or down by at most two points. The various investment alternatives plus their returns ($10,000s), given the interest rate changes, are shown in the following table:

Determine the best investment, using the following decision criteria.

Determine the best investment, using the following decision criteria.

a. Maximax

b. Maximin

c. Equal likelihood

Problem 1

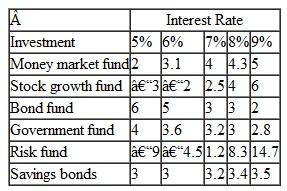

Ann Tyler has come into an inheritance from her grandparents. She is attempting to decide among several investment alternatives. The return after 1 year is primarily dependent on the interest rate during the next year. The rate is currently 7%, and Ann anticipates that it will stay the same or go up or down by at most two points. The various investment alternatives plus their returns ($10,000s), given the interest rate changes, are shown in the following table:

Determine the best investment, using the following decision criteria.

Determine the best investment, using the following decision criteria.a. Maximax

b. Maximin

c. Equal likelihood

Problem 2

In Problem, Ann Tyler, with the help of a financial newsletter and some library research, has been able to assign probabilities to each of the possible interest rates during the next year, as follows:

Using expected value, determine her best investment decision.

Using expected value, determine her best investment decision.Problem

Ann Tyler has come into an inheritance from her grandparents. She is attempting to decide among several investment alternatives. The return after 1 year is primarily dependent on the interest rate during the next year. The rate is currently 7%, and Ann anticipates that it will stay the same or go up or down by at most two points. The various investment alternatives plus their returns ($10,000s), given the interest rate changes, are shown in the following table:

Determine the best investment, using the following decision criteria.

Determine the best investment, using the following decision criteria.a. Maximax

b. Maximin

c. Equal likelihood

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Introduction to Management Science 12th Edition by Bernard Taylor

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255