Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

النسخة 13الرقم المعياري الدولي: 978-1285420929

Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

النسخة 13الرقم المعياري الدولي: 978-1285420929 تمرين 3

Referring to Exercise again:

a. Holding constant the effects of branching (X 1 ), determine the level of total assets that minimizes the average operating expense ratio.

b. Determine the average operating expense ratio for a savings and loan association with the level of total assets determined in Part (a) and 1 branch. Same question for 10 branches.

Exercise

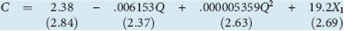

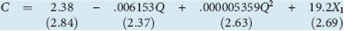

A study of 86 savings and loan associations in six northwestern states yielded the following cost function: 15

where C = average operating expense ratio, expressed as a percentage and defined as total operating expense ($ million) divided by total assets ($ million) times 100 percent

Q = output; measured by total assets ($million)

X 1 = ratio of the number of branches to total assets ($million)

Note: The number in parentheses below each coefficient is its respective t-statistic.

a. Which variable(s) is(are) statistically significant in explaining variations in the average operating expense ratio

b. What type of cost-output relationship (e.g., linear, quadratic, or cubic) is suggested by these statistical results

c. Based on these results, what can we conclude about the existence of economies or diseconomies of scale in savings and loan associations in the Northwest

15 Holton Wilson, "A Note on Scale Economies in the Savings and Loan Industry," Business Economics (January 1981), pp. 45-49.

a. Holding constant the effects of branching (X 1 ), determine the level of total assets that minimizes the average operating expense ratio.

b. Determine the average operating expense ratio for a savings and loan association with the level of total assets determined in Part (a) and 1 branch. Same question for 10 branches.

Exercise

A study of 86 savings and loan associations in six northwestern states yielded the following cost function: 15

where C = average operating expense ratio, expressed as a percentage and defined as total operating expense ($ million) divided by total assets ($ million) times 100 percent

Q = output; measured by total assets ($million)

X 1 = ratio of the number of branches to total assets ($million)

Note: The number in parentheses below each coefficient is its respective t-statistic.

a. Which variable(s) is(are) statistically significant in explaining variations in the average operating expense ratio

b. What type of cost-output relationship (e.g., linear, quadratic, or cubic) is suggested by these statistical results

c. Based on these results, what can we conclude about the existence of economies or diseconomies of scale in savings and loan associations in the Northwest

15 Holton Wilson, "A Note on Scale Economies in the Savings and Loan Industry," Business Economics (January 1981), pp. 45-49.

التوضيح

a) Level of total assets that minimizes ...

Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255