Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

النسخة 13الرقم المعياري الدولي: 978-1285420929

Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

النسخة 13الرقم المعياري الدولي: 978-1285420929 تمرين 16

Netflix and Redbox Compete for Movie Rentals 30

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

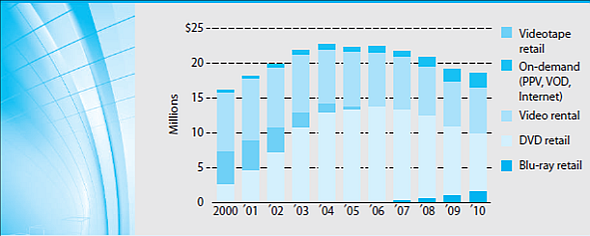

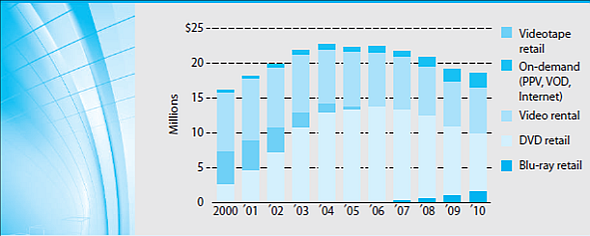

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Who are Netflix's and Redbox's suppliers Are they in a position to appropriate much of the value in the value chain Why or why not

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Who are Netflix's and Redbox's suppliers Are they in a position to appropriate much of the value in the value chain Why or why not

التوضيح

Suppliers are the major source for any r...

Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255