Microeconomic Theory 11th Edition by Walter Nicholson,Christopher Snyder

النسخة 11الرقم المعياري الدولي: 978-1111525538

Microeconomic Theory 11th Edition by Walter Nicholson,Christopher Snyder

النسخة 11الرقم المعياري الدولي: 978-1111525538 تمرين 4

Suppose there is a 50-50 chance that a risk-averse individual with a current wealth of $20,000 will contract a debilitating disease and suffer a loss of $10,000.

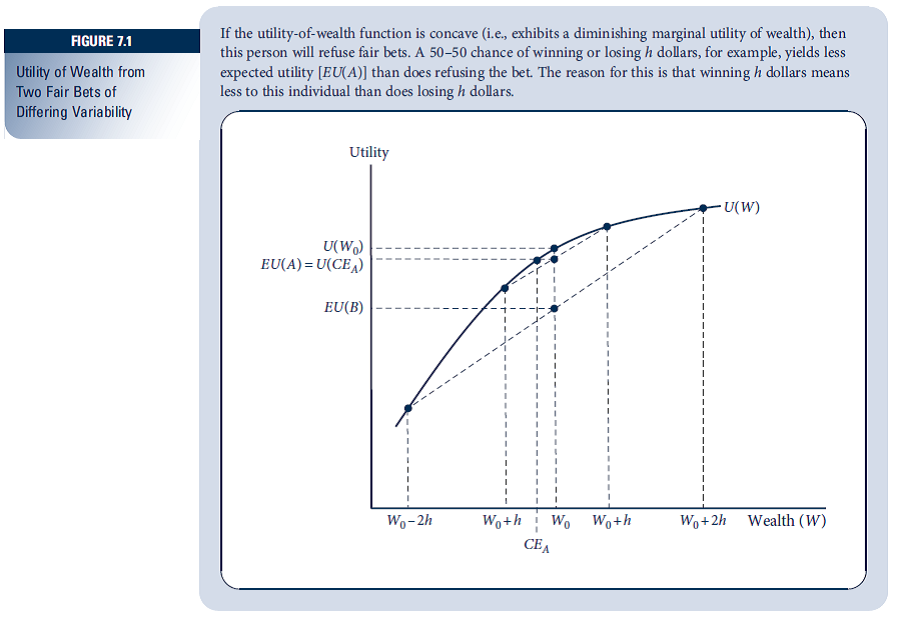

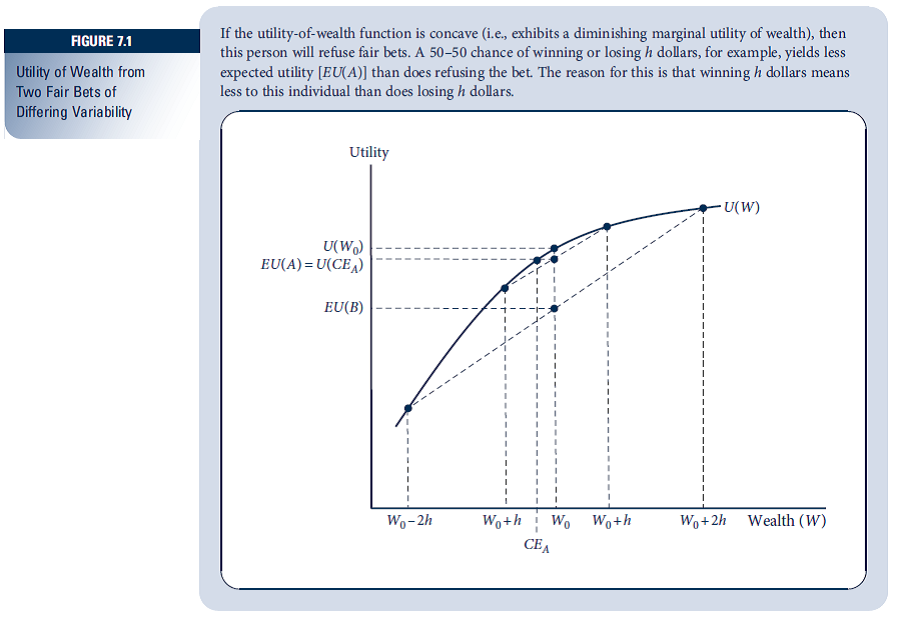

a. Calculate the cost of actuarially fair insurance in this situation and use a utility-of-wealth graph (such as shown in Figure 7.1) to show that the individual will prefer fair insurance against this loss to accepting the gamble uninsured.

b. Suppose two types of insurance policies were available:

(1) a fair policy covering the complete loss; and

(2) a fair policy covering only half of any loss incurred.

Calculate the cost of the second type of policy and show that the individual will generally regard it as inferior to the first.

Reference: Figure 7.1

a. Calculate the cost of actuarially fair insurance in this situation and use a utility-of-wealth graph (such as shown in Figure 7.1) to show that the individual will prefer fair insurance against this loss to accepting the gamble uninsured.

b. Suppose two types of insurance policies were available:

(1) a fair policy covering the complete loss; and

(2) a fair policy covering only half of any loss incurred.

Calculate the cost of the second type of policy and show that the individual will generally regard it as inferior to the first.

Reference: Figure 7.1

التوضيح

a) Fair insurance premium is given by th...

Microeconomic Theory 11th Edition by Walter Nicholson,Christopher Snyder

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255