Real Estate Principles 3rd Edition by David Ling,Wayne Archer

النسخة 3الرقم المعياري الدولي: 978-0073377322

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

النسخة 3الرقم المعياري الدولي: 978-0073377322 تمرين 19

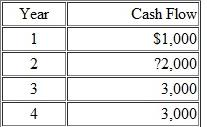

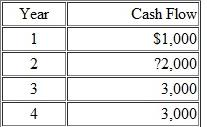

Assume a property is priced at $5,000 and has the following income stream:

Would an investor with a required rate of return of 15 percent be wise to invest at the current price

Would an investor with a required rate of return of 15 percent be wise to invest at the current price

A) No, because the project has a net present value of $1,139.15.

B) No, because the project has a net present value of $1,954.91.

C) Yes, because the project has a net present value of $1,069.66.

D) Yes, because the project has a net present value of $1,954.91.

E) An investor would be indifferent between purchasing and not purchasing the above property at the stated price.

Would an investor with a required rate of return of 15 percent be wise to invest at the current price

Would an investor with a required rate of return of 15 percent be wise to invest at the current priceA) No, because the project has a net present value of $1,139.15.

B) No, because the project has a net present value of $1,954.91.

C) Yes, because the project has a net present value of $1,069.66.

D) Yes, because the project has a net present value of $1,954.91.

E) An investor would be indifferent between purchasing and not purchasing the above property at the stated price.

التوضيح

The correct answer is option B. No, beca...

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255