International Business 13th Edition by Donald Ball,Michael Geringer,Michael Minor ,Jeanne McNett

النسخة 13الرقم المعياري الدولي: 978-0077606121

International Business 13th Edition by Donald Ball,Michael Geringer,Michael Minor ,Jeanne McNett

النسخة 13الرقم المعياري الدولي: 978-0077606121 تمرين 4

State Manufacturing Company, a producer of farm equipment, had just received an inquiry from a large distributor in Italy. The quantity on which the distributor wanted a price was sufficiently large that Jim Mason, the sales manager, felt he had to respond. He knew the inquiry was genuine, because he had called two of the companies that the distributor said he represented, and both had assured him that the Italian firm, Agricole Italiana, was a serious one. It paid its bills regularly with no problems. Both companies were selling to the firm on open account terms.

Mason's problem was that he had never quoted on a sale for export before. His first impulse was to take the regular Ex Works price and add the cost of the extra-heavy export packing plus the inland freight cost to the nearest U.S. port. This price should enable the company to make money if he quoted the price FAS port of exit.

However, the terms of sale were bothering him. The traffic manager had called a foreign freight forwarder to learn about the frequency of sailings to Italy, and during the conversation she had suggested to the traffic manager that she might be able to help Mason. When Mason called her, he learned that because of competition, many firms like State Manufacturing were quoting CIF foreign port as a convenience to the importer. She asked him what payment terms he would quote, and he replied that his credit manager had suggested an irrevocable, confirmed letter of credit to be sure of receiving payment for the sale. He admitted that the distributor, however, had asked for payment against a 90-day time draft.

The foreign freight forwarder urged Mason to consider quoting CIF port of entry in Italy with payment as requested by the distributor to be more competitive. She informed him that he could get insurance to protect the company against commercial risk. To help him calculate a CIF price, she offered to give him the various charges if he would tell her the weight and value of his shipment FOB factory. He replied that the total price was $21,500 and that the gross weight, including the container, was 3,629 kilos.

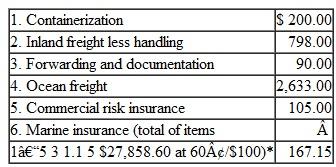

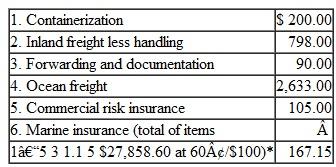

Two hours later, she called to give him the following charges:

*Total coverage of marine insurance is commonly calculated on the basis of the total price plus 10 percent.

*Total coverage of marine insurance is commonly calculated on the basis of the total price plus 10 percent.

During that time, Mason had been thinking about the competition. Could he lower the FOB price for an export sale? He looked at the cost figures. Sales expense amounted to 20 percent of the sales price. Couldn't this be deducted on a foreign order? Research and development amounted to 10 percent. Should this be charged? Advertising and promotional expense amounted to another 10 percent. What about that? Because this was an unsolicited inquiry, there was no selling expense for this sale except for his and the secretary's time. Mason felt that it wasn't worth calculating this time.

If you were Jim Mason, how would you calculate the CIF port of entry price?

Mason's problem was that he had never quoted on a sale for export before. His first impulse was to take the regular Ex Works price and add the cost of the extra-heavy export packing plus the inland freight cost to the nearest U.S. port. This price should enable the company to make money if he quoted the price FAS port of exit.

However, the terms of sale were bothering him. The traffic manager had called a foreign freight forwarder to learn about the frequency of sailings to Italy, and during the conversation she had suggested to the traffic manager that she might be able to help Mason. When Mason called her, he learned that because of competition, many firms like State Manufacturing were quoting CIF foreign port as a convenience to the importer. She asked him what payment terms he would quote, and he replied that his credit manager had suggested an irrevocable, confirmed letter of credit to be sure of receiving payment for the sale. He admitted that the distributor, however, had asked for payment against a 90-day time draft.

The foreign freight forwarder urged Mason to consider quoting CIF port of entry in Italy with payment as requested by the distributor to be more competitive. She informed him that he could get insurance to protect the company against commercial risk. To help him calculate a CIF price, she offered to give him the various charges if he would tell her the weight and value of his shipment FOB factory. He replied that the total price was $21,500 and that the gross weight, including the container, was 3,629 kilos.

Two hours later, she called to give him the following charges:

*Total coverage of marine insurance is commonly calculated on the basis of the total price plus 10 percent.

*Total coverage of marine insurance is commonly calculated on the basis of the total price plus 10 percent.During that time, Mason had been thinking about the competition. Could he lower the FOB price for an export sale? He looked at the cost figures. Sales expense amounted to 20 percent of the sales price. Couldn't this be deducted on a foreign order? Research and development amounted to 10 percent. Should this be charged? Advertising and promotional expense amounted to another 10 percent. What about that? Because this was an unsolicited inquiry, there was no selling expense for this sale except for his and the secretary's time. Mason felt that it wasn't worth calculating this time.

If you were Jim Mason, how would you calculate the CIF port of entry price?

التوضيح

Calculate the CIF port of entry price by...

International Business 13th Edition by Donald Ball,Michael Geringer,Michael Minor ,Jeanne McNett

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255