Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 25

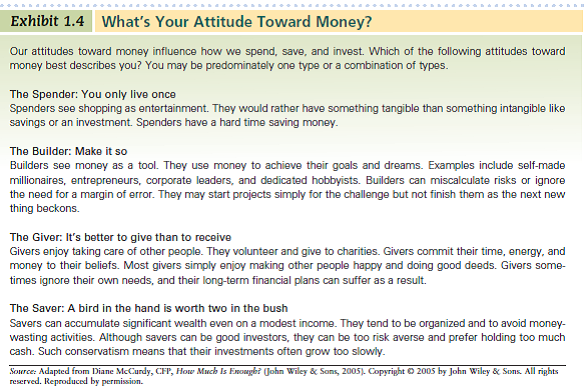

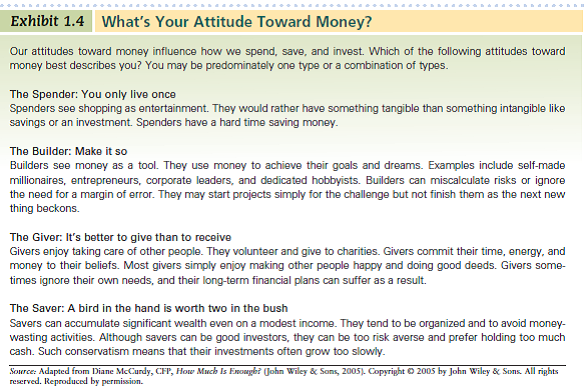

Many people's attitude toward money has as much or more to do with their ability to accumulate wealth as it does with the amount of money they earn. As observed in Exhibit 1.4, your attitude toward money influences the entire financial planning process and often determines whether financial goals become reality or end up being pipe dreams. This project will help you examine your attitude toward money and wealth so that you can formulate realistic goals and plans.

Use the following questions to stimulate your thought process.

a. Am I a saver, or do I spend almost all the money I receive

b. Does it make me feel good just to spend money, regardless of what it's for

c. Is it important for me to have new clothes or a new car just for the sake of having them

d. Do I have clothes hanging in my closet with the price tags still on them

e. Do I buy things because they are a bargain or because I need them

f. Do I save for my vacations, or do I charge everything and take months paying off my credit card at high interest

g. If I have a balance on my credit card, can I recall what the charges were for without looking at my statement

h. Where do I want to be professionally and financially in 5 years In 10 years

i. Will my attitude toward money help get me there If not, what do I need to do

j. If I dropped out of school today or lost my job, what would I do

Does your attitude toward money help or hinder you How can you adjust your attitude so that you are more likely to accomplish your financial goals

(Reference Exhibit 1.4)

Use the following questions to stimulate your thought process.

a. Am I a saver, or do I spend almost all the money I receive

b. Does it make me feel good just to spend money, regardless of what it's for

c. Is it important for me to have new clothes or a new car just for the sake of having them

d. Do I have clothes hanging in my closet with the price tags still on them

e. Do I buy things because they are a bargain or because I need them

f. Do I save for my vacations, or do I charge everything and take months paying off my credit card at high interest

g. If I have a balance on my credit card, can I recall what the charges were for without looking at my statement

h. Where do I want to be professionally and financially in 5 years In 10 years

i. Will my attitude toward money help get me there If not, what do I need to do

j. If I dropped out of school today or lost my job, what would I do

Does your attitude toward money help or hinder you How can you adjust your attitude so that you are more likely to accomplish your financial goals

(Reference Exhibit 1.4)

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255