Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 17

Murali and Amita Kapoor are a married couple in their early 20s living in Denver. Murali Kapoor earned $73,000 in 2011 from his job as a sales assistant. During the year, his employer withheld $4,975 for income tax purposes. In addition, the Kapoors received interest of $350 on a joint savings account, $750 interest on tax-exempt municipal bonds, and dividends of $400 on common stocks. At the end of 2011, the Kapoors sold two stocks, A and B. Stock A was sold for $700 and had been purchased four months earlier for $800. Stock B was sold for $1,500 and had been purchased three years earlier for $1,100. Their only child, Nalin, age 2, received (as his sole source of income) dividends of $200 from Hershey stock.

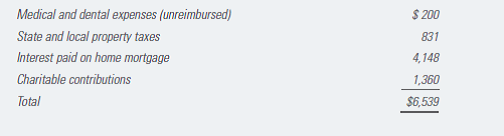

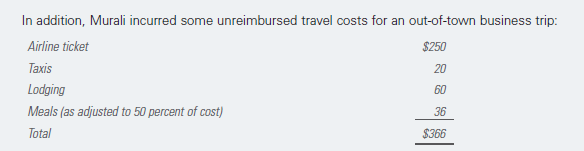

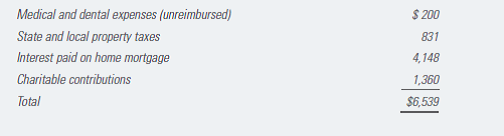

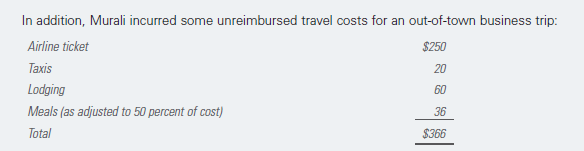

Although Murali is covered by his company's pension plan, he plans to contribute $5,000 to a traditional deductible IRA for 2011. Here are the amounts of money paid out during the year by the Kapoors:

Critical Thinking Questions

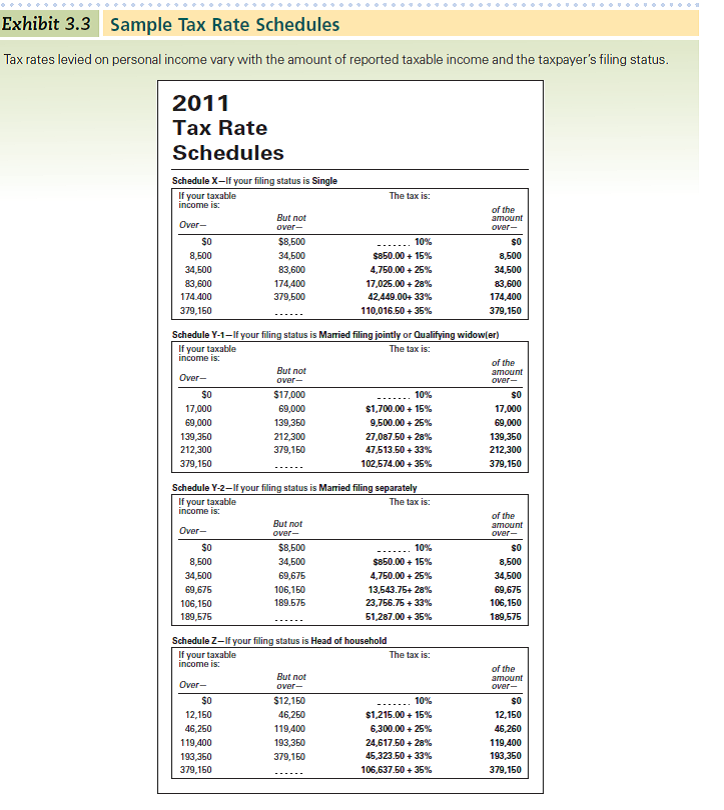

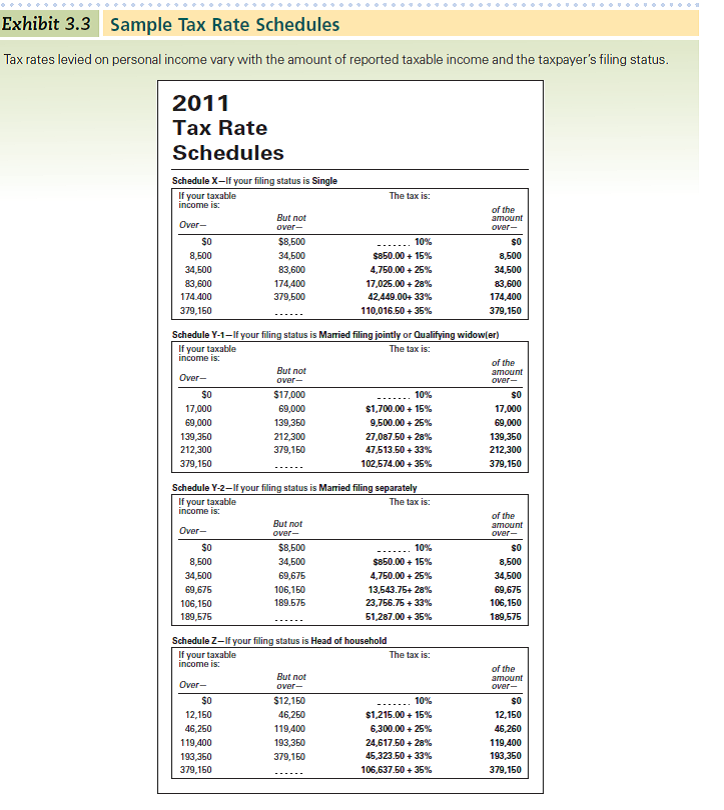

1. Using the Kapoors' information, determine the total amount of their itemized deductions. Assume that they'll use the filing status of married filing jointly, the standard deduction for that status is $11,600, and each exemption claimed is worth $3,700. Should they itemize or take the standard deduction Prepare a joint tax return for Murali and Amita Kapoor for the year ended December 31, 2011, that gives them the smallest tax liability. Use the appropriate tax rate schedule provided in Exhibit 3.3 to calculate their taxes owed.

2. How much have you saved the Kapoors through your treatment of their deductions

3. Discuss whether the Kapoors need to file a tax return for their son.

4. Suggest some tax strategies that the Kapoors might use to reduce their tax liability for next year.

REFERENCE EXHIBIT:

Although Murali is covered by his company's pension plan, he plans to contribute $5,000 to a traditional deductible IRA for 2011. Here are the amounts of money paid out during the year by the Kapoors:

Critical Thinking Questions

1. Using the Kapoors' information, determine the total amount of their itemized deductions. Assume that they'll use the filing status of married filing jointly, the standard deduction for that status is $11,600, and each exemption claimed is worth $3,700. Should they itemize or take the standard deduction Prepare a joint tax return for Murali and Amita Kapoor for the year ended December 31, 2011, that gives them the smallest tax liability. Use the appropriate tax rate schedule provided in Exhibit 3.3 to calculate their taxes owed.

2. How much have you saved the Kapoors through your treatment of their deductions

3. Discuss whether the Kapoors need to file a tax return for their son.

4. Suggest some tax strategies that the Kapoors might use to reduce their tax liability for next year.

REFERENCE EXHIBIT:

التوضيح

Persons MK and AK are married with a 2-y...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255