Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 9

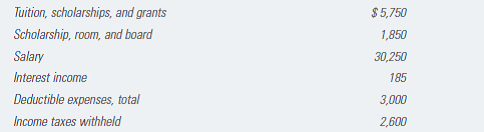

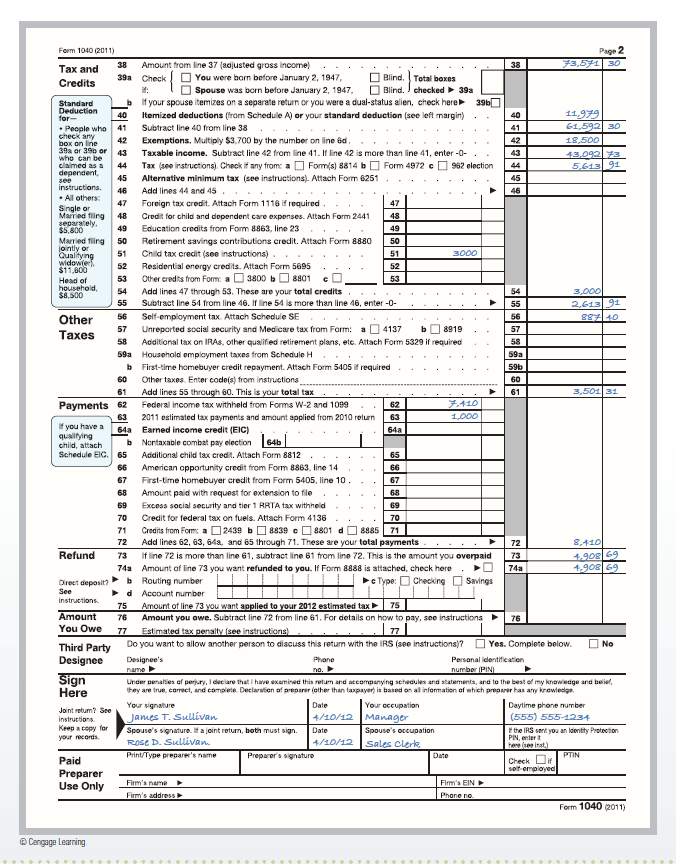

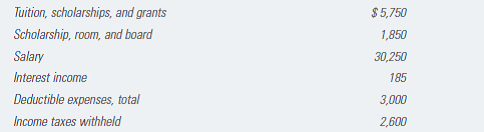

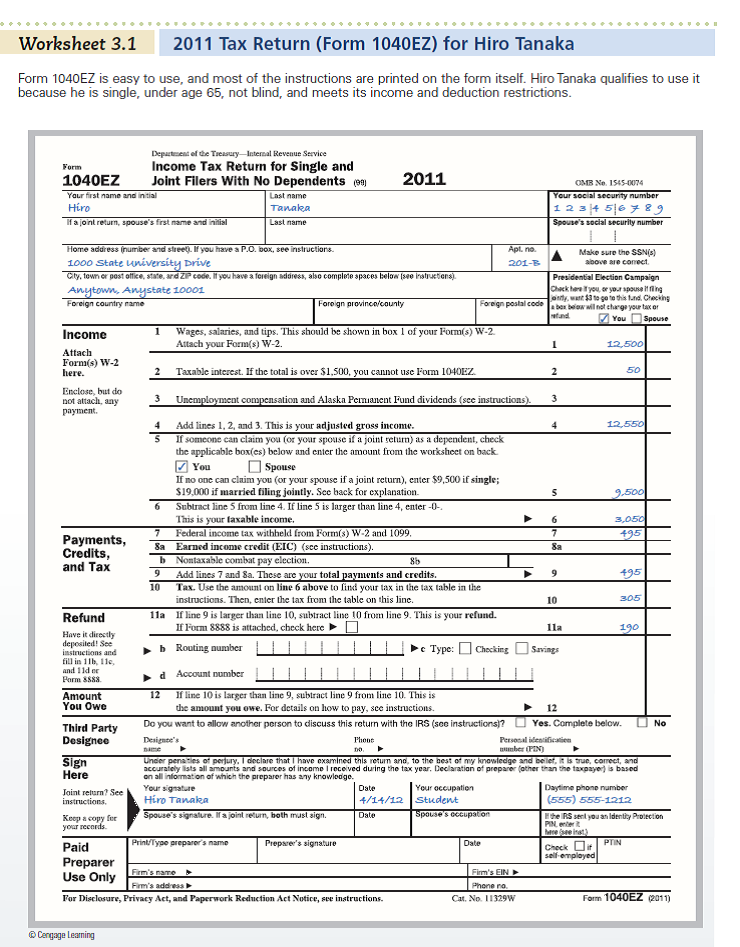

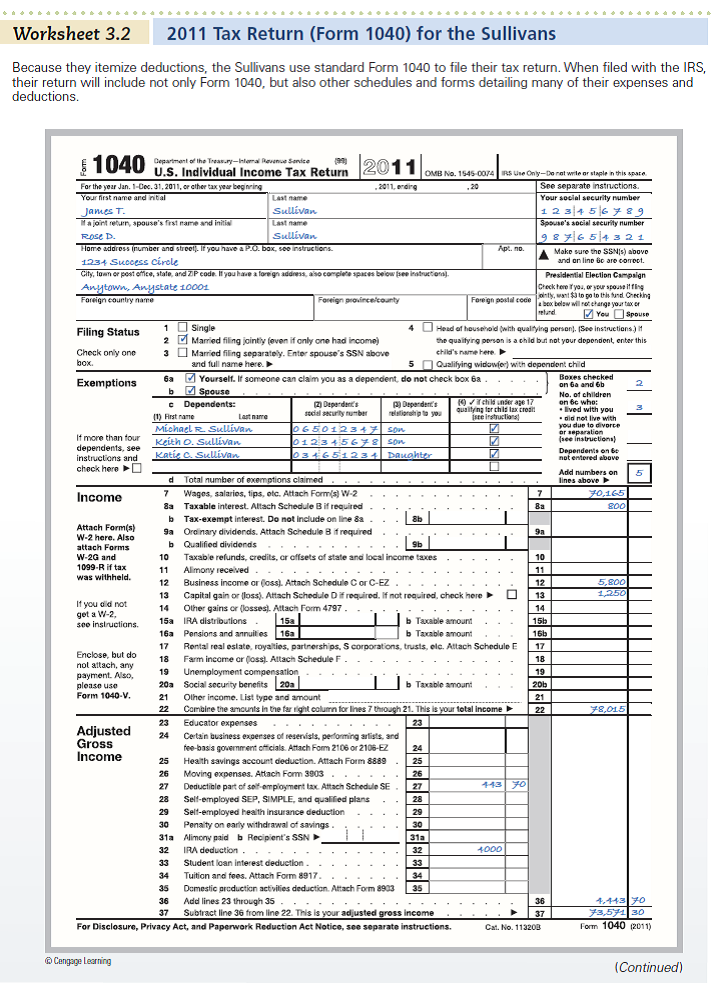

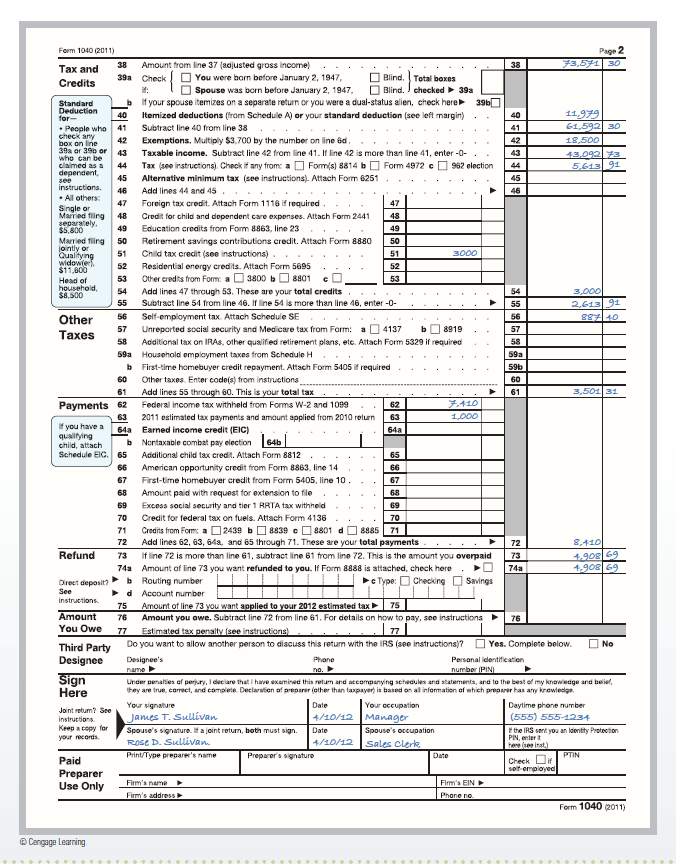

Use Worksheets 3.1 and 3.2. Qiang Gao graduated from college in 2011 and began work as a systems analyst in July 2011. He is preparing to file his income tax return for 2011 and has collected the following financial information for calendar year 2011:

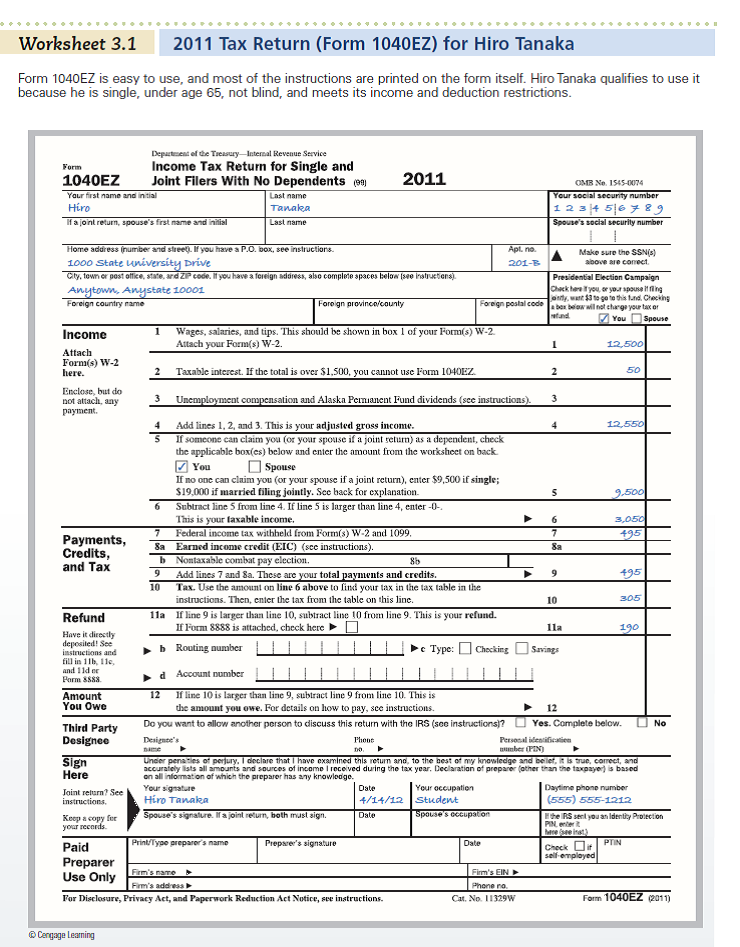

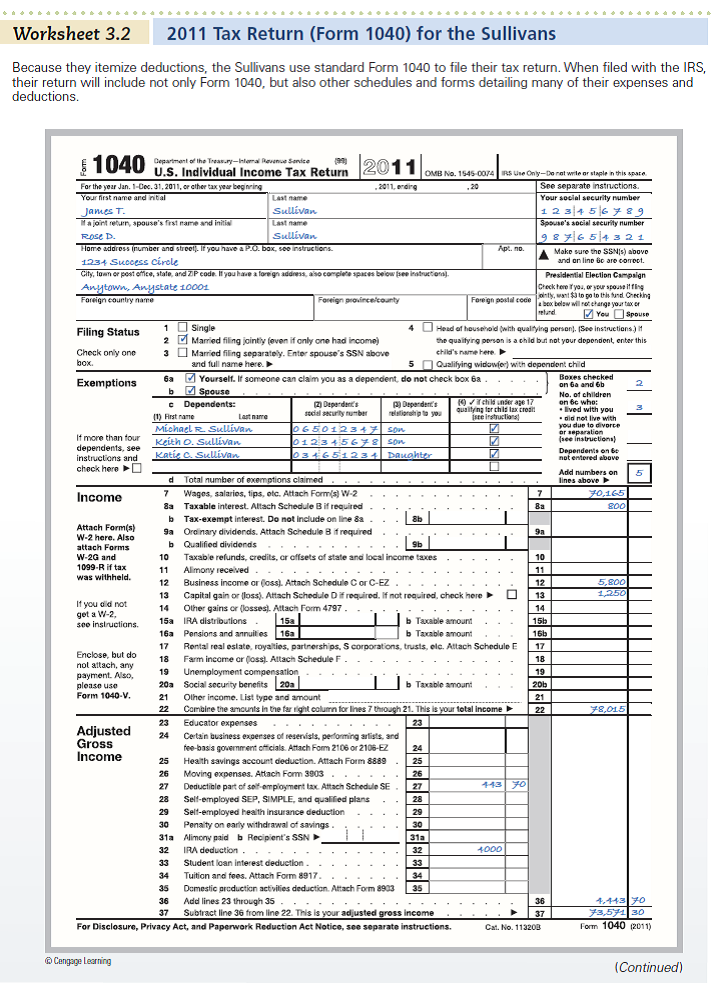

a. Prepare Qiang's 2011 tax return, using a $5,450 standard deduction, a personal exemption of $3,500, and the tax rates given in Exhibit 3.3. Which tax form should Qiang use, and why

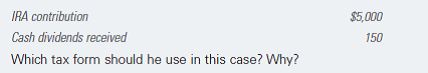

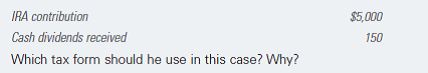

b. Prepare Qiang's 2011 tax return using the data in part a, along with the following information:

REFERENCE:

a. Prepare Qiang's 2011 tax return, using a $5,450 standard deduction, a personal exemption of $3,500, and the tax rates given in Exhibit 3.3. Which tax form should Qiang use, and why

b. Prepare Qiang's 2011 tax return using the data in part a, along with the following information:

REFERENCE:

التوضيح

Person QG is a recent college graduate w...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255