Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 11

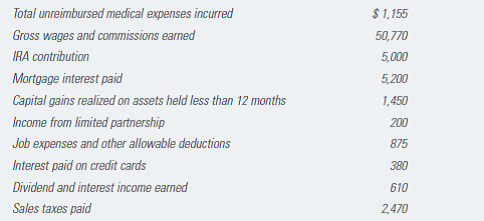

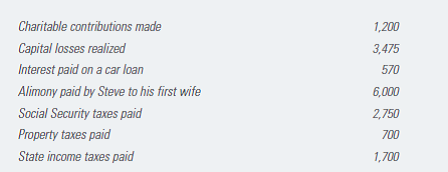

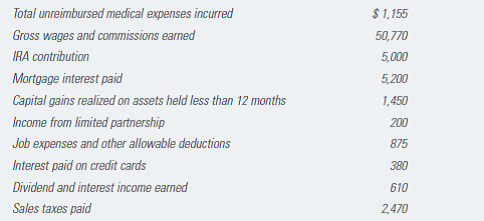

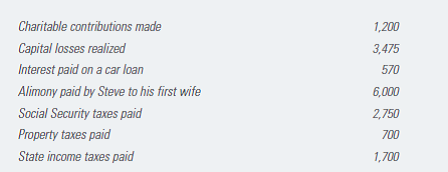

Steve and Beth Compton are married and have one child. Steve is putting together some figures so that he can prepare the Comptons' joint 2011 tax return. He can claim three personal exemptions (including himself). So far, he's been able to determine the following with regard to income and possible deductions:

Given this information, how much taxable income will the Comptons have in 2011 ( Note: Assume that Steve is covered by a pension plan where he works, the standard deduction of $11,600 for married filing jointly applies, and each exemption claimed is worth $3,700.)

Given this information, how much taxable income will the Comptons have in 2011 ( Note: Assume that Steve is covered by a pension plan where he works, the standard deduction of $11,600 for married filing jointly applies, and each exemption claimed is worth $3,700.)

التوضيح

Person SC and BC are married with a chil...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255