Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 32

Sophia Harris is a single woman in her late 20s. She is renting an apartment in the fashionable part of town for $1,200 a month. After much thought, she's seriously considering buying a condominium for $175,000. She intends to put 20 percent down and expects that closing costs will amount to another $5,000; a commercial bank has agreed to lend her money at the fixed rate of 6 percent on a 15-year mortgage. Sophia would have to pay an annual condominium owner's insurance premium of $600 and property taxes of $1,200 a year (she's now paying renter's insurance of $550 per year). In addition, she estimates that annual maintenance expenses will be about 0.5 percent of the price of the condo (which includes a $30 monthly fee to the property owners' association). Sophia's income puts her in the 25 percent tax bracket (she itemizes her deductions on her tax returns), and she earns an after-tax rate of return on her investments of around 4 percent.

Critical Thinking Questions

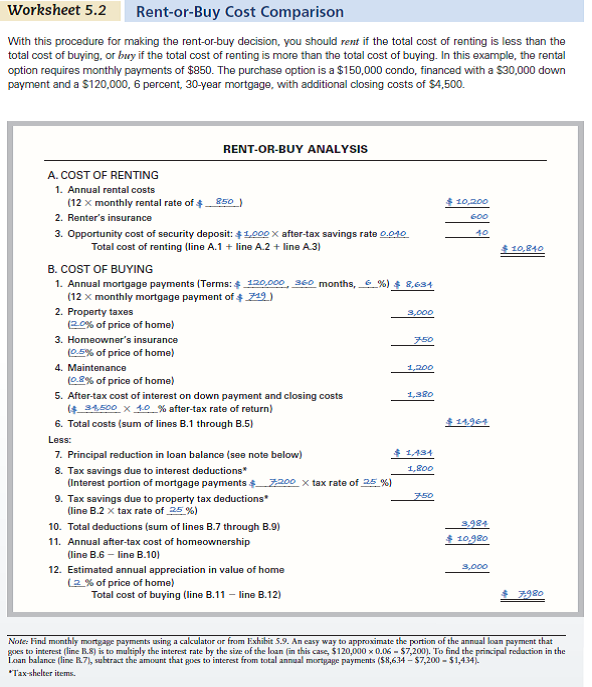

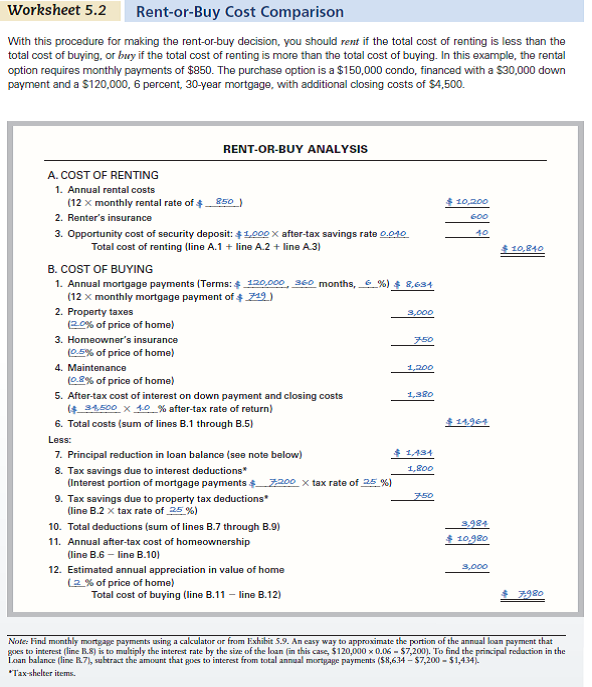

1. Given the information provided, use Worksheet 5.2 to evaluate and compare Sophia's alternatives of remaining in the apartment or purchasing the condo.

2. Working with a friend who is a realtor, Sophia has learned that condos like the one that she's thinking of buying are appreciating in value at the rate of 3.5 percent a year and are expected to continue doing so. Would such information affect the rent-or-buy decision made in Question 1

Explain.

3. Discuss any other factors that should be considered when making a rent-or-buy decision.

4. Which alternative would you recommend for Sophia in light of your analysis

(Reference Worksheet 5.2)

Critical Thinking Questions

1. Given the information provided, use Worksheet 5.2 to evaluate and compare Sophia's alternatives of remaining in the apartment or purchasing the condo.

2. Working with a friend who is a realtor, Sophia has learned that condos like the one that she's thinking of buying are appreciating in value at the rate of 3.5 percent a year and are expected to continue doing so. Would such information affect the rent-or-buy decision made in Question 1

Explain.

3. Discuss any other factors that should be considered when making a rent-or-buy decision.

4. Which alternative would you recommend for Sophia in light of your analysis

(Reference Worksheet 5.2)

التوضيح

Person SH currently rents an apartment f...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255