Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 25

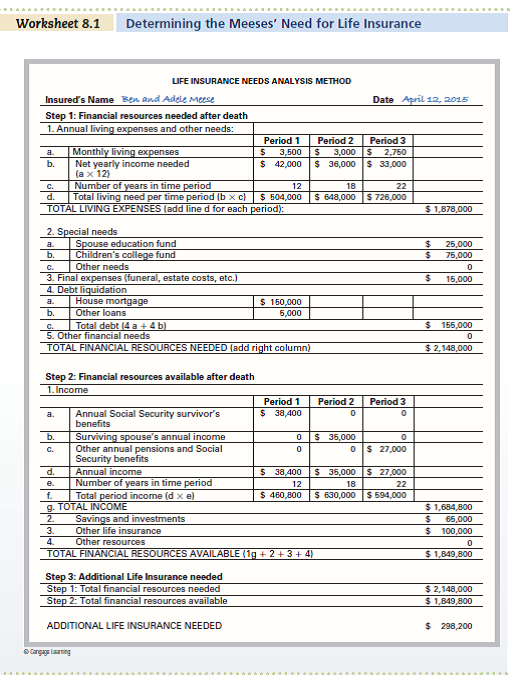

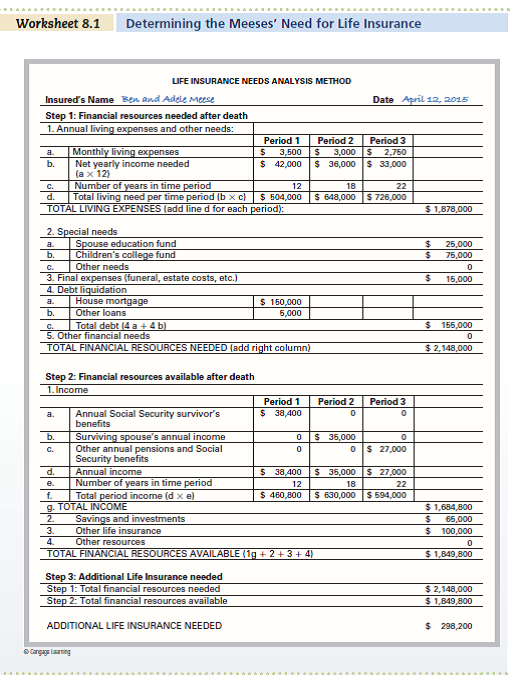

Use Worksheet 8.1. Adam Modine, 43, is a recently divorced father of two children, ages 9 and 7. He currently earns $95,000 a year as an operations manager for a utility company. The divorce settlement requires him to pay $1,500 a month in child support and $400 a month in alimony to his ex-wife, who currently earns $25,000 annually as a preschool teacher. Adam is now renting an apartment, and the divorce settlement left him with about $100,000 in savings and retirement benefits. His employer provides a $75,000 life insurance policy. Adam's ex-wife is currently the beneficiary listed on the policy. What advice would you give to Adam What factors should he consider in deciding whether to buy additional life insurance at this point in his life If he does need additional life insurance, what type of policy or policies should he buy Use Worksheet 8.1 to help answer these questions for Adam.

REFERENCE:

REFERENCE:

التوضيح

Person AM is a 43-year-old divorced fath...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255