Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 3

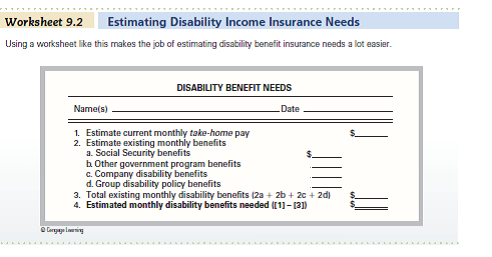

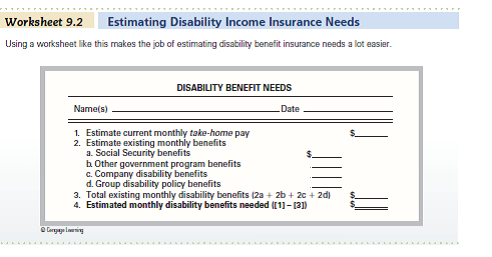

Use Worksheet 9.2. Bruce Kaplan, a 35-year-old computer programmer, earns $72,000 a year. His monthly take-home pay is $3,750. His wife, Barbara, works part-time at their children's elementary school but receives no benefits. Under state law, Barbara's employer contributes to a workers' compensation insurance fund that would provide $2,250 per month for six months if Bruce were disabled and unable to work.

a. Use Worksheet 9.2 to calculate Bruce's disability insurance needs, assuming that he won't qualify for Medicare under his Social Security benefits.

b. Based on your answer in part a , what would you advise Bruce about his need for additional disability income insurance Discuss the type and size of disability income insurance coverage he should consider, including possible provisions he might want to include. What other factors should he take into account if he decides to purchase a policy

REFERENCE:

a. Use Worksheet 9.2 to calculate Bruce's disability insurance needs, assuming that he won't qualify for Medicare under his Social Security benefits.

b. Based on your answer in part a , what would you advise Bruce about his need for additional disability income insurance Discuss the type and size of disability income insurance coverage he should consider, including possible provisions he might want to include. What other factors should he take into account if he decides to purchase a policy

REFERENCE:

التوضيح

Person BK is 35 and earns $72,000 annual...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255