Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 29

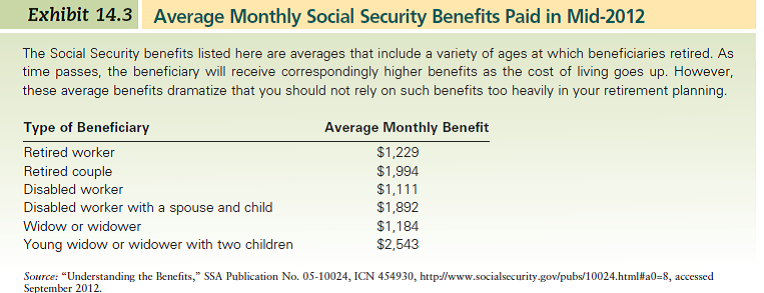

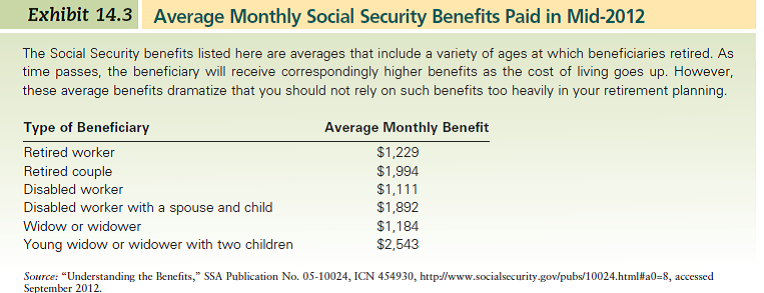

Use Exhibit 14.3 to estimate the average Social Security benefits for a retired couple. Assume that one spouse has a part-time job that pays $24,000 a year, and that this person also receives another $47,000 a year from a company pension. Based on current policies, would this couple be liable for any tax on their Social Security income

التوضيح

The information and computations given b...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255