Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

النسخة 13الرقم المعياري الدولي: 978-1111971632 تمرين 13

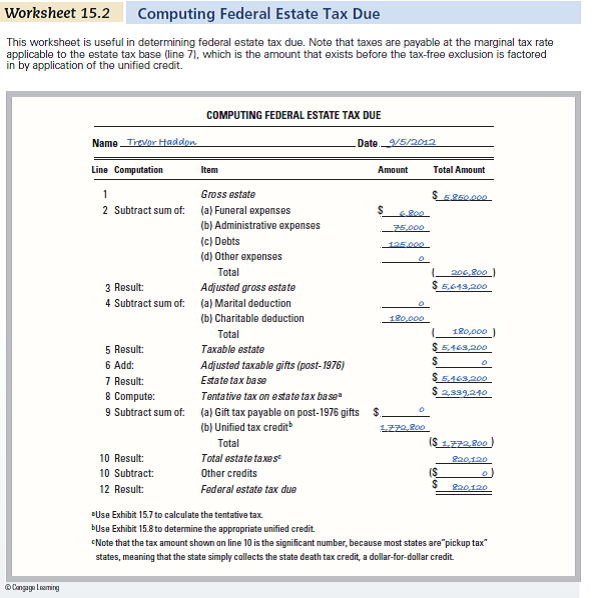

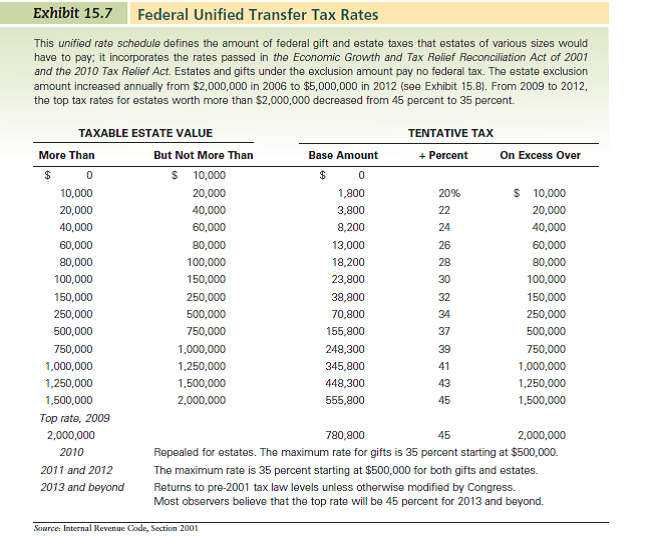

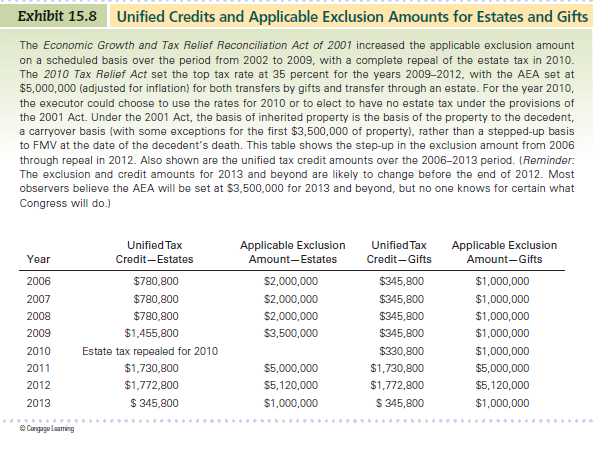

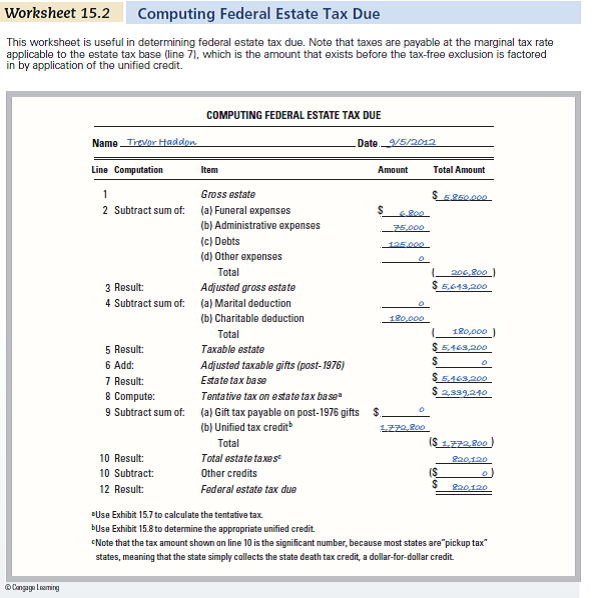

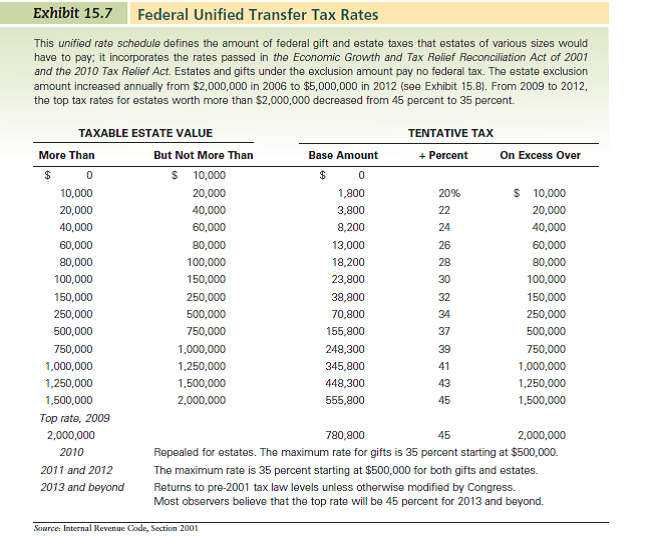

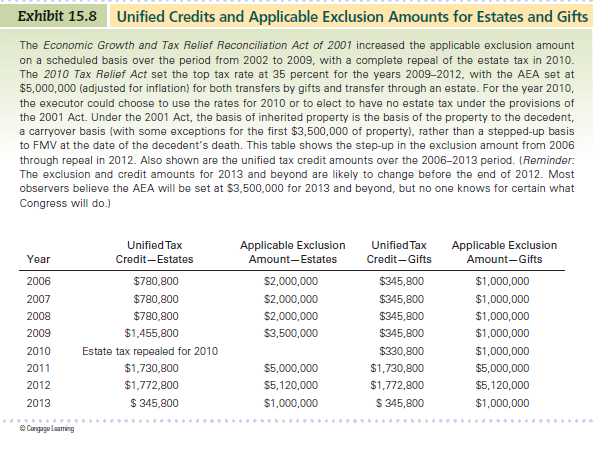

Use Worksheet 15.2. When Russell Hypes died unmarried in 2012, he left an estate valued at $7,850,000. His trust directed distribution as follows: $20,000 to the local hospital, $160,000 to his alma mater, and the remainder to his three adult children. Death-related costs and expenses were $16,800 for funeral expenses, $40,000 paid to attorneys, $5,000 paid to accountants, and $30,000 paid to the trustee of his living trust. In addition, there were debts of $125,000. Use Worksheet 15.2 and Exhibits 15.7 and 15.8 to calculate the federal estate tax due on his estate.

(Reference Worksheet 15.2 and Exhibits 15.7 and 15.8 )

(Reference Worksheet 15.2 and Exhibits 15.7 and 15.8 )

التوضيح

Since Person RH died in 2012, the tax re...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255