PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

النسخة 3الرقم المعياري الدولي: 978-1285082578

PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

النسخة 3الرقم المعياري الدولي: 978-1285082578 تمرين 2

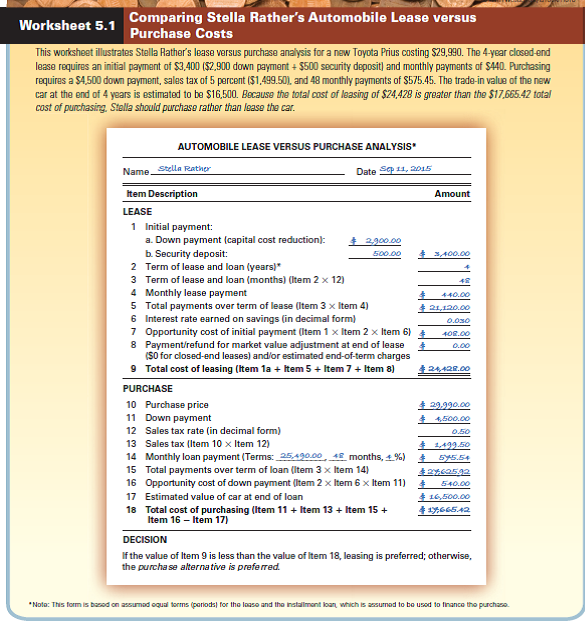

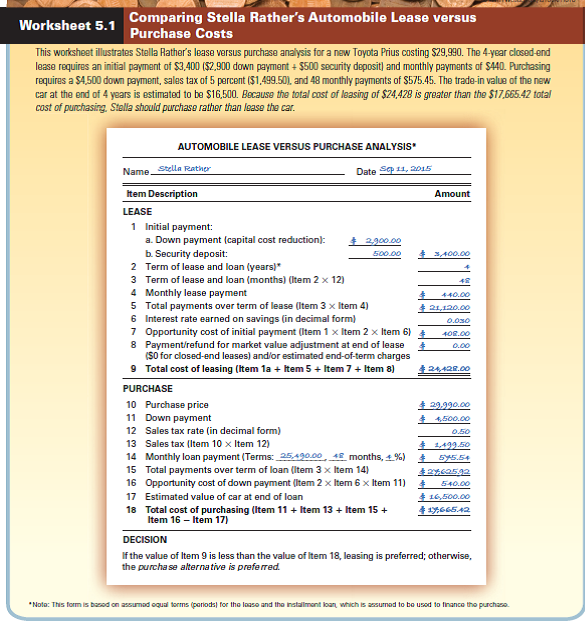

Use Worksheet 5.1. Damien Smart is trying to decide whether to lease or purchase a new car costing $18,000. If he leases, he'll have to pay a $600 security deposit and monthly payments of $450 over the 36-month term of the closed-end lease. On the other hand, if he buys the car, then he'll have to make a $2,400 down payment and will finance the balance with a 36-month loan requiring monthly payments of $515; he'll also have to pay a 6 percent sales tax ($1,080) on the purchase price, and he expects the car to have a residual value of $6,500 at the end of three years. Use the automobile lease versus purchase analysis form in Worksheet 5.1 to find the total cost of both the lease and the purchase and then recommend the best strategy for Damien.

التوضيح

To buy a car costing $18000, Mr. DS has ...

PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255