PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

النسخة 3الرقم المعياري الدولي: 978-1285082578

PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

النسخة 3الرقم المعياري الدولي: 978-1285082578 تمرين 3

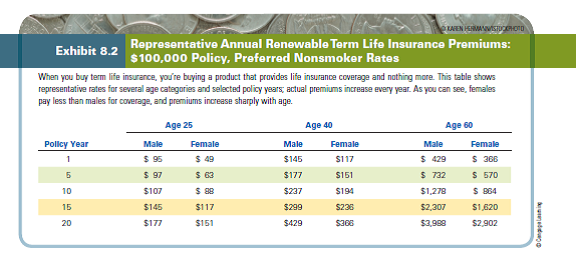

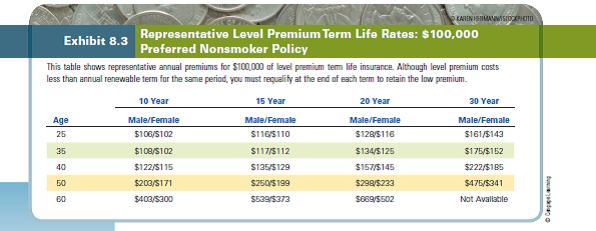

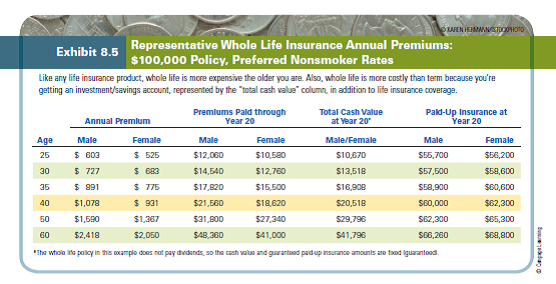

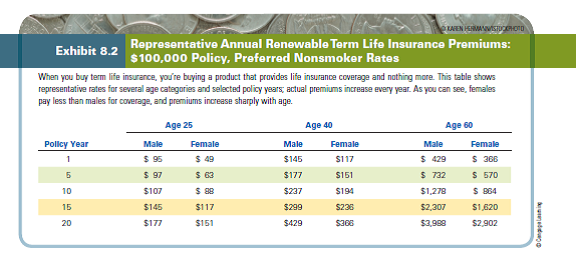

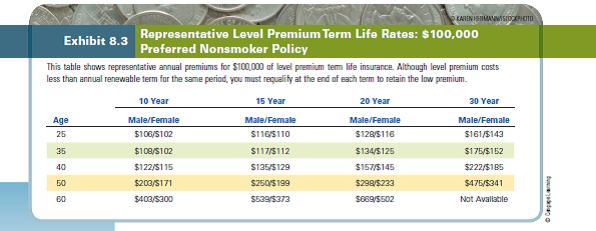

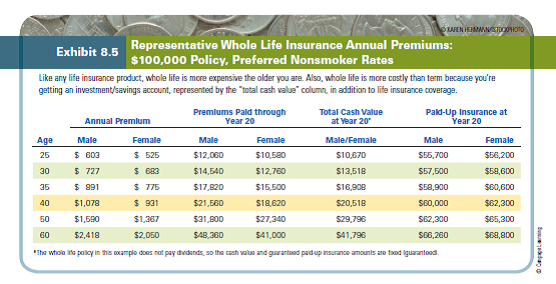

Using the premium schedules provided in Exhibits 8.2, 8.3, and 8.5, how much in annual premiums would a 25-year-old male have to pay for $100,000 of annual renewable term, level premium term, and whole life insurance? (Assume a five-year term or period of coverage.) How much would a 25-year-old woman have to pay for the same coverage? Consider a 40-year-old male (or female): Using annual premiums, compare the cost of 10 years of coverage under annual renewable and level premium term options and whole life insurance coverage. Relate the advantages and disadvantages of each policy type to their price differences.

التوضيح

The annual premium for 25-year-old male ...

PFIN 3rd Edition by Lawrence Gitman,Michael Joehnk,Randall Billingsley

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255