Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 15

Continuing Company Analysis-Amazon and Best Buy: Ratio of liabilities to stockholders' equity

Amazon.com, Inc. is one of the largest Internet retailers in the world. We will use Amazon as a continuing company exercise to reinforce the various tools and techniques for analyzing financial statements. We will begin with the ratio of liabilities to stockholders' equity.

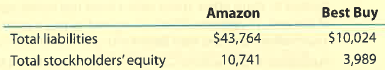

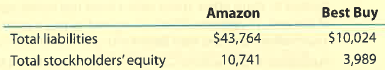

Ratios can be used to compare companies in the same industry. For Amazon, there are a number of competitors that sell media, electronic, and other merchandise. Best Buy, Inc. is one such company. The following total liabilities and stockholders' equity information (in millions) is provided for Amazon and Best Buy for the end of a recent year:

A. Compute the ratio of liabilities to stockholders' equity for each company. (Round to two decimal places.)

B. What conclusions regarding the margin of protection to creditors can you draw for these two companies?

Amazon.com, Inc. is one of the largest Internet retailers in the world. We will use Amazon as a continuing company exercise to reinforce the various tools and techniques for analyzing financial statements. We will begin with the ratio of liabilities to stockholders' equity.

Ratios can be used to compare companies in the same industry. For Amazon, there are a number of competitors that sell media, electronic, and other merchandise. Best Buy, Inc. is one such company. The following total liabilities and stockholders' equity information (in millions) is provided for Amazon and Best Buy for the end of a recent year:

A. Compute the ratio of liabilities to stockholders' equity for each company. (Round to two decimal places.)

B. What conclusions regarding the margin of protection to creditors can you draw for these two companies?

التوضيح

Liability to Stockholder's equity Ratio ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255