Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 1

Financial statements

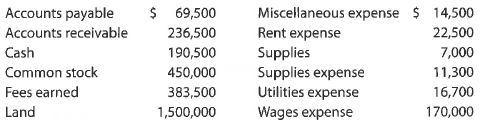

The amounts of the assets and liabilities of Journey Travel Agency at December 31, 2018, the end of the year, and its revenue and expenses for the year follow. The retained earnings were $1,341,000 on January 1, 2018, the beginning of the year. During the year, dividends of $75,000 were paid.

Instructions

1. Prepare an income statement for the year ended December 31, 2018.

2. Prepare a retained earnings statement for the year ended December 31, 2018.

3. Prepare a balance sheet as of December 31, 2018.

4. What item appears on both the retained earnings statement and the balance sheet?

The amounts of the assets and liabilities of Journey Travel Agency at December 31, 2018, the end of the year, and its revenue and expenses for the year follow. The retained earnings were $1,341,000 on January 1, 2018, the beginning of the year. During the year, dividends of $75,000 were paid.

Instructions

1. Prepare an income statement for the year ended December 31, 2018.

2. Prepare a retained earnings statement for the year ended December 31, 2018.

3. Prepare a balance sheet as of December 31, 2018.

4. What item appears on both the retained earnings statement and the balance sheet?

التوضيح

Income statement is record of all incomes and expenses only. It gives us the final profit, which is finally transferred to Balance sheet. And this is further appropriated in statement of retained earnings, which belong to owner of business.

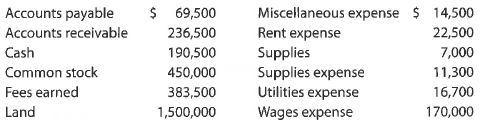

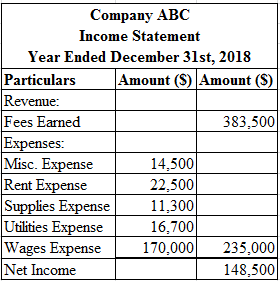

1.Following is a detailed income statement for the period of January 1, 2018 to December 31, 2018 for the ABC; using Excel sheet is shown as below:

The result of above Excel sheet is given below:

The result of above Excel sheet is given below:

In above tabular format computation is done for net income where all expenses are deducted from fees earned.Hence, Net Income is fees earned less all expenses shown in above statement are

In above tabular format computation is done for net income where all expenses are deducted from fees earned.Hence, Net Income is fees earned less all expenses shown in above statement are

.

.

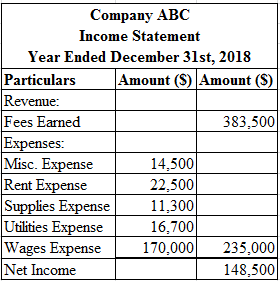

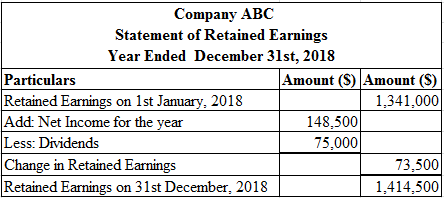

2.Retaining earnings is a statement which gives summary of the opening and closing in the net income adjusting retained earnings and dividend paid that have occurred for the year ended on December 31, 2018. Following is the calculation using Excel sheet:

The result of above Excel sheet is given below:

The result of above Excel sheet is given below:

Hence, retained earnings for end of year 2018 is

Hence, retained earnings for end of year 2018 is

.

.

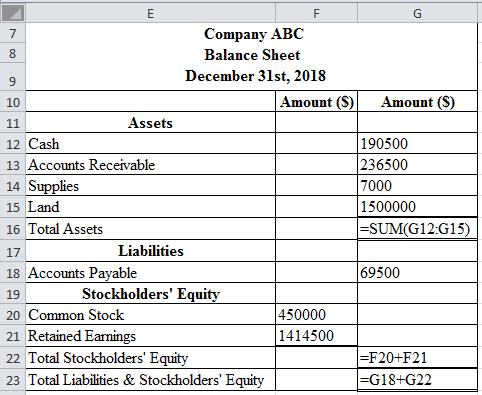

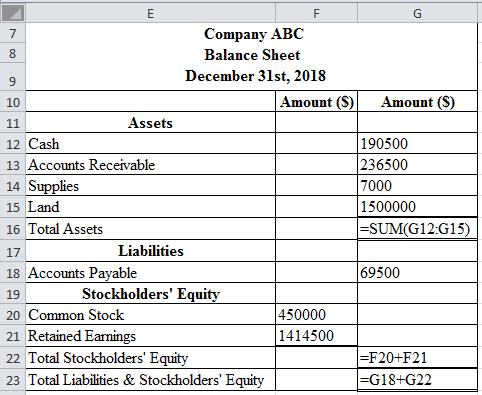

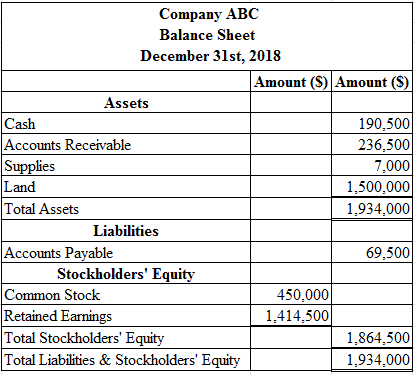

3.It is required to prepare Balance Sheet as on December 31, 2018. Following is the calculation using Excel sheet:

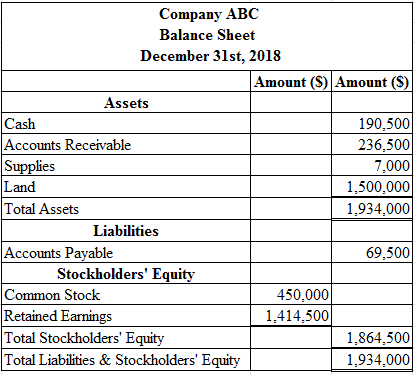

The result of above Excel sheet is given below:

The result of above Excel sheet is given below:

The balance sheet involves all details of assets, liabilities, and stockholders' equity at the last day of the accounting period. Total of balances of balance sheet must match that represents lesser chances of recording error in books of accounts. In above case matched balance is $1,934,000.

The balance sheet involves all details of assets, liabilities, and stockholders' equity at the last day of the accounting period. Total of balances of balance sheet must match that represents lesser chances of recording error in books of accounts. In above case matched balance is $1,934,000.

4.There is an accounting flow of preparing financial statements, income statement and balance sheet is prepared from trial balance. In above sub parts three statements are prepared. From first statement of income statement, item net income is transferred to statement of retained earnings. And from above two statements it is seen that retained earning so computed at end of period is transferred to balance sheet. So, retained earnings are item common in both balance sheet and retained earnings.

Retained earnings are that part of earnings which are not distributed as dividend and are used for further growth of company. This item appears on liability side of balance sheet under head f shareholder's equity fund.

Hence, a "retained earnings" is an item appears on both retained earnings statement and balance sheet.

1.Following is a detailed income statement for the period of January 1, 2018 to December 31, 2018 for the ABC; using Excel sheet is shown as below:

The result of above Excel sheet is given below:

The result of above Excel sheet is given below: In above tabular format computation is done for net income where all expenses are deducted from fees earned.Hence, Net Income is fees earned less all expenses shown in above statement are

In above tabular format computation is done for net income where all expenses are deducted from fees earned.Hence, Net Income is fees earned less all expenses shown in above statement are .

.2.Retaining earnings is a statement which gives summary of the opening and closing in the net income adjusting retained earnings and dividend paid that have occurred for the year ended on December 31, 2018. Following is the calculation using Excel sheet:

The result of above Excel sheet is given below:

The result of above Excel sheet is given below: Hence, retained earnings for end of year 2018 is

Hence, retained earnings for end of year 2018 is .

.3.It is required to prepare Balance Sheet as on December 31, 2018. Following is the calculation using Excel sheet:

The result of above Excel sheet is given below:

The result of above Excel sheet is given below: The balance sheet involves all details of assets, liabilities, and stockholders' equity at the last day of the accounting period. Total of balances of balance sheet must match that represents lesser chances of recording error in books of accounts. In above case matched balance is $1,934,000.

The balance sheet involves all details of assets, liabilities, and stockholders' equity at the last day of the accounting period. Total of balances of balance sheet must match that represents lesser chances of recording error in books of accounts. In above case matched balance is $1,934,000.4.There is an accounting flow of preparing financial statements, income statement and balance sheet is prepared from trial balance. In above sub parts three statements are prepared. From first statement of income statement, item net income is transferred to statement of retained earnings. And from above two statements it is seen that retained earning so computed at end of period is transferred to balance sheet. So, retained earnings are item common in both balance sheet and retained earnings.

Retained earnings are that part of earnings which are not distributed as dividend and are used for further growth of company. This item appears on liability side of balance sheet under head f shareholder's equity fund.

Hence, a "retained earnings" is an item appears on both retained earnings statement and balance sheet.

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255