Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 40

Papa Johns and Yum! Brands: Ratio of liabilities to stockholders' equity

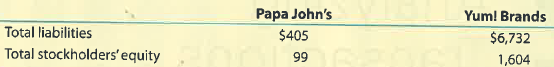

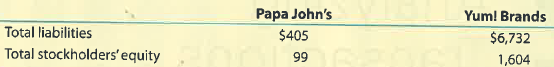

The following total liabilities and stockholders' equity information (in millions) is provided for Papa John's International, Inc. and Yum! Brands, Inc. at the end of a recent year:

Yum! Brands is a much larger company than is Papa John's, however both companies compete internationally in the fast food business. Papa John's is primarily in the carry-out and delivery pizza business, while Yum! Brands is in the quick-service restaurant business with its Pizza Hut, Taco Bell, and KFC brands.

A. Compute the ratio of liabilities to stockholders' equity for each company. (Round to one decimal place.)

B. What conclusions regarding the margin of protection to creditors can you draw for these two companies?

C. Which company is more risky to creditors?

The following total liabilities and stockholders' equity information (in millions) is provided for Papa John's International, Inc. and Yum! Brands, Inc. at the end of a recent year:

Yum! Brands is a much larger company than is Papa John's, however both companies compete internationally in the fast food business. Papa John's is primarily in the carry-out and delivery pizza business, while Yum! Brands is in the quick-service restaurant business with its Pizza Hut, Taco Bell, and KFC brands.

A. Compute the ratio of liabilities to stockholders' equity for each company. (Round to one decimal place.)

B. What conclusions regarding the margin of protection to creditors can you draw for these two companies?

C. Which company is more risky to creditors?

التوضيح

Stockholder's Equity

It is the source o...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255