Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 50

Journal entries and trial balance

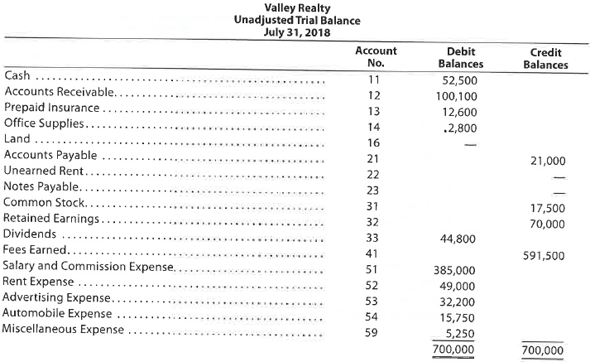

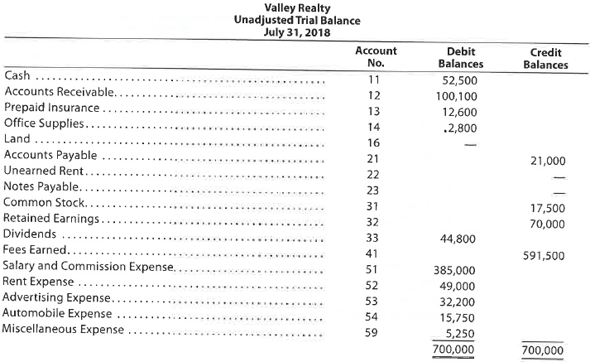

Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2018, follows:

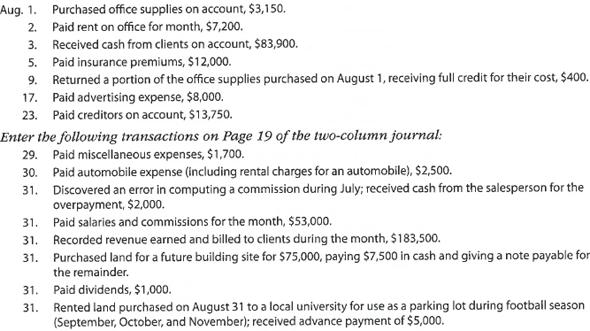

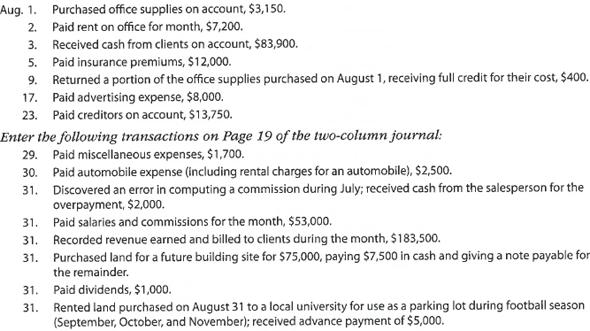

The following business transactions were completed by Valley Realty during August 2018:

Instructions

1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (?) in the Posting Reference column.

2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of August 31, 2018.

5. Assume that the August 31 transaction for dividends should have been $10,000. (A) Why did the unadjusted trial balance in (4) balance? (B) Journalize the correcting entry. (C) Is this error a transposition or slide?

Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2018, follows:

The following business transactions were completed by Valley Realty during August 2018:

Instructions

1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (?) in the Posting Reference column.

2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of August 31, 2018.

5. Assume that the August 31 transaction for dividends should have been $10,000. (A) Why did the unadjusted trial balance in (4) balance? (B) Journalize the correcting entry. (C) Is this error a transposition or slide?

التوضيح

Company VR is an agency which is dealing...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255