Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 33

Adjusting entries

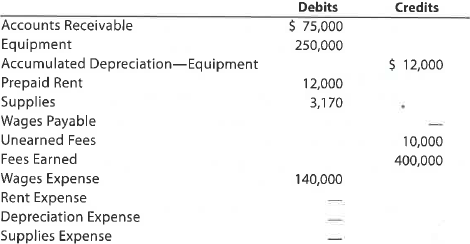

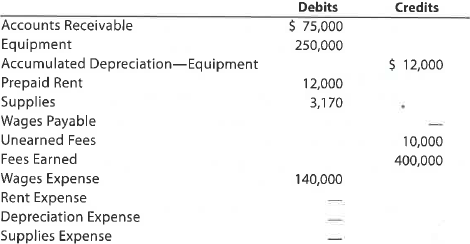

Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow:

Data needed for year-end adjustments are as follows:

• Supplies on hand at November 30, $550.

• Depreciation of equipment during year, $1,675.

• Rent expired during year, $8,500.

• Wages accrued but not paid at November 30, $2,000.

• Unearned fees at November 30, $4,000.

• Unbilled fees at November 30, $5,380.

Instructions

1. Journalize the six adjusting entries required at November 30, based on the data presented.

2. What would be the effect on the income statement if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

3. What would be the effect on the balance sheet if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow:

Data needed for year-end adjustments are as follows:

• Supplies on hand at November 30, $550.

• Depreciation of equipment during year, $1,675.

• Rent expired during year, $8,500.

• Wages accrued but not paid at November 30, $2,000.

• Unearned fees at November 30, $4,000.

• Unbilled fees at November 30, $5,380.

Instructions

1. Journalize the six adjusting entries required at November 30, based on the data presented.

2. What would be the effect on the income statement if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

3. What would be the effect on the balance sheet if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

التوضيح

There are two areas where such adjusted ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255