Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 53

Continuing Company Analysis-Amazon: Working capital and current ratio

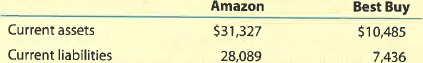

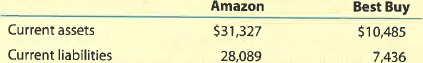

Amazon.com, Inc. is the largest Internet retailer in the United States. Best Buy, Inc. is a leading retailer of technology and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. The current assets and current liabilities from recent balance sheets for both companies are provided as follows (in millions):

A. Compute the working capital for each company.

B. Which company has the largest working capital?

C. Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

D. Compute the current ratio for both companies. (Round to one decimal place.)

E. Which company has the larger relative liquidity based on the current ratio?

Amazon.com, Inc. is the largest Internet retailer in the United States. Best Buy, Inc. is a leading retailer of technology and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. The current assets and current liabilities from recent balance sheets for both companies are provided as follows (in millions):

A. Compute the working capital for each company.

B. Which company has the largest working capital?

C. Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

D. Compute the current ratio for both companies. (Round to one decimal place.)

E. Which company has the larger relative liquidity based on the current ratio?

التوضيح

The given question depicts the current a...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255