Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 10

T accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet

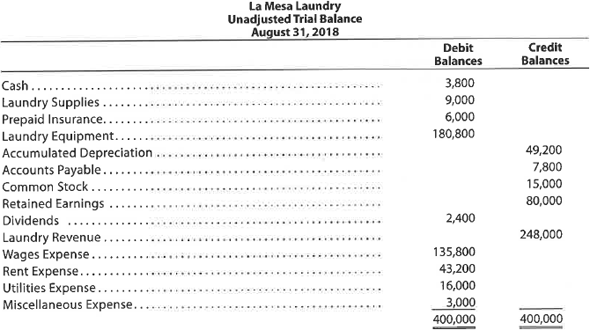

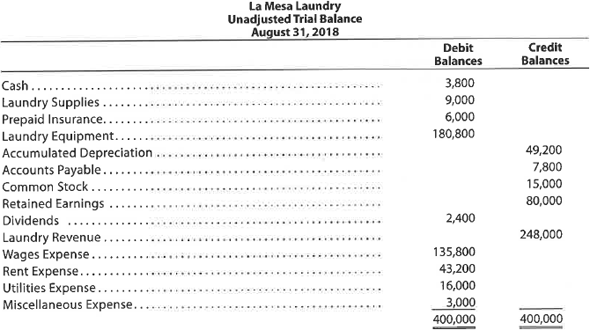

The unadjusted trial balance of La Mesa Laundry at August 31, 2018, the end of the fiscal year, follows:

The data needed to determine year-end adjustments are as follows:

(A) Wages accrued but not paid at August 31 are $2,200.

(B) Depreciation of equipment during the year is $8,150.

(C) Laundry supplies on hand at August 31 are $2,000.

(D) Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as "Aug. 31 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by "Adj." and the new balances as "Adj. Bal."

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a retained earnings statement, and a balance sheet.

6. Journalize and post the closing entries. Identify the closing entries by "Clos."

7. Prepare a post-closing trial balance.

The unadjusted trial balance of La Mesa Laundry at August 31, 2018, the end of the fiscal year, follows:

The data needed to determine year-end adjustments are as follows:

(A) Wages accrued but not paid at August 31 are $2,200.

(B) Depreciation of equipment during the year is $8,150.

(C) Laundry supplies on hand at August 31 are $2,000.

(D) Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as "Aug. 31 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by "Adj." and the new balances as "Adj. Bal."

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a retained earnings statement, and a balance sheet.

6. Journalize and post the closing entries. Identify the closing entries by "Clos."

7. Prepare a post-closing trial balance.

التوضيح

Unadjusted trial balance

It is not a co...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255