Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 54

Bank reconciliation and entries

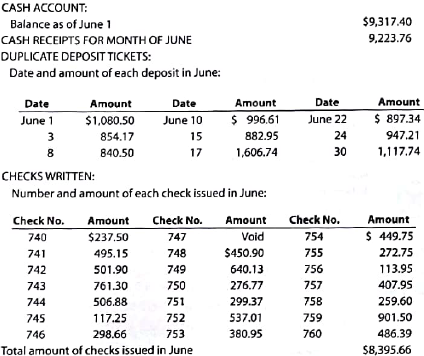

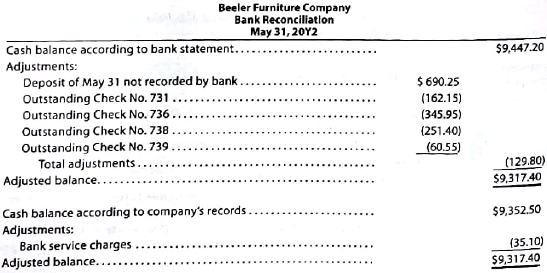

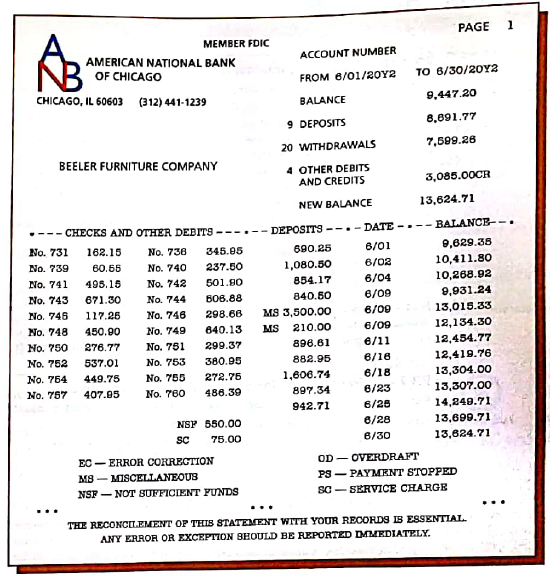

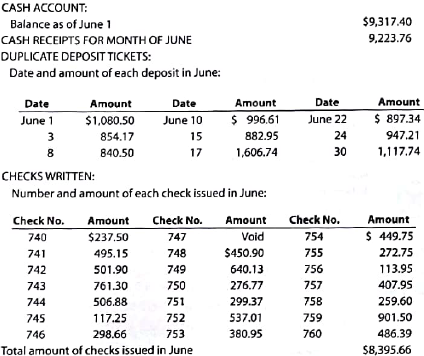

Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of June 30, 20Y2, have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account.

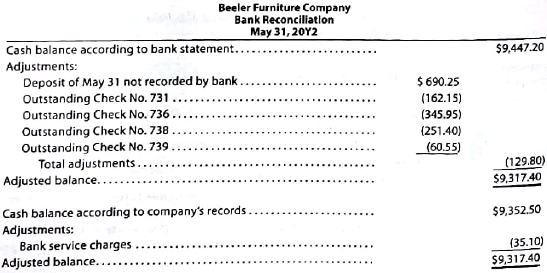

BANK RECONCILIATION FOR PRECEDING MONTH:

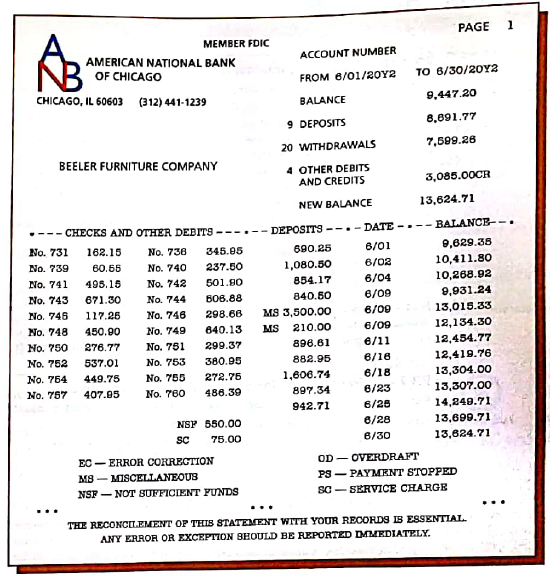

JUNE BANK STATEMENT:

Instructions

1. Prepare a bank reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable.

2. Journalize the necessary entries.

3. What is the amount of cash that should appear on the balance sheet as of June 30, 20Y2?

4. Assume that a canceled check for $390 has been incorrectly recorded by the bank as $930. Briefly explain how the error would be included in a bank reconciliation and how it should be corrected.

Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of June 30, 20Y2, have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account.

BANK RECONCILIATION FOR PRECEDING MONTH:

JUNE BANK STATEMENT:

Instructions

1. Prepare a bank reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable.

2. Journalize the necessary entries.

3. What is the amount of cash that should appear on the balance sheet as of June 30, 20Y2?

4. Assume that a canceled check for $390 has been incorrectly recorded by the bank as $930. Briefly explain how the error would be included in a bank reconciliation and how it should be corrected.

التوضيح

Bank Reconciliation Statement

BRS is a ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255