Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 31

Entries for bad debt expense under the direct write-off and allowance methods

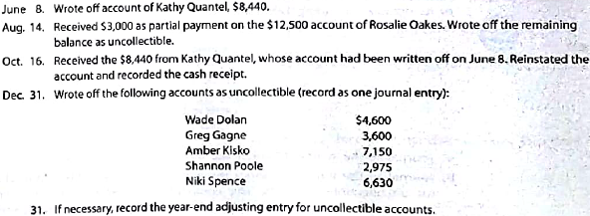

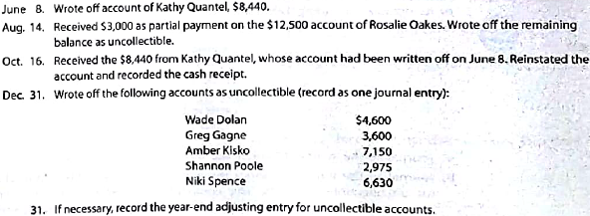

The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31:

A. Journalize the transactions under the direct write-off method.

B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable:

C. How much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance method?

The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31:

A. Journalize the transactions under the direct write-off method.

B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable:

C. How much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance method?

التوضيح

Direct Write-off Method

Direct Write-of...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255