Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 47

Entries for bad debt expense under the direct write-off and allowance methods

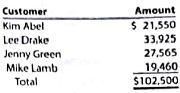

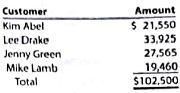

Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31:

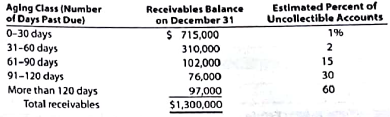

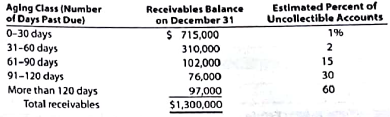

The Company prepared the following aging schedule for its accounts receivable on December 31:

A. Journalize the write-offs under the direct write-off method.

B. Journalize the write-offs and the year-end abjusting entry under the allowance method, assuming that the allowance account has a beginning balance of $95,000 and the company uses the analysis of receivables method.

C. How much higher (lower) would Seaforth Internation's net income have been under the allowance method than under the direct write-off method?

Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31:

The Company prepared the following aging schedule for its accounts receivable on December 31:

A. Journalize the write-offs under the direct write-off method.

B. Journalize the write-offs and the year-end abjusting entry under the allowance method, assuming that the allowance account has a beginning balance of $95,000 and the company uses the analysis of receivables method.

C. How much higher (lower) would Seaforth Internation's net income have been under the allowance method than under the direct write-off method?

التوضيح

Direct Write-off Method

Direct Write-of...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255