Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 60

Comparing three depreciation methods

Dexter Industries purchased packaging equipment on January 8 for $72,000, The equipment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $4,500, The equipment was used for 7,600 hours during Year 1, 6,000 hours in Year 2, and 4,400 hours in Year 3.

Instructions

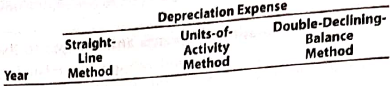

1. Determine the amount of depreciation expense for the three years ending December 31, by (A) the straight-line method, (B) the units-of-activity method, and (C) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. The following columnar heading are suggested for recording the depreciation expense amounts:

2. What method yields the highest depreciation expense for Year 1?

3. What method yields the most depreciation over the three-year life of the equipment?

Dexter Industries purchased packaging equipment on January 8 for $72,000, The equipment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $4,500, The equipment was used for 7,600 hours during Year 1, 6,000 hours in Year 2, and 4,400 hours in Year 3.

Instructions

1. Determine the amount of depreciation expense for the three years ending December 31, by (A) the straight-line method, (B) the units-of-activity method, and (C) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. The following columnar heading are suggested for recording the depreciation expense amounts:

2. What method yields the highest depreciation expense for Year 1?

3. What method yields the most depreciation over the three-year life of the equipment?

التوضيح

Depreciation

It is the expense that cre...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255