Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 8

Payroll accounts and year-end entries

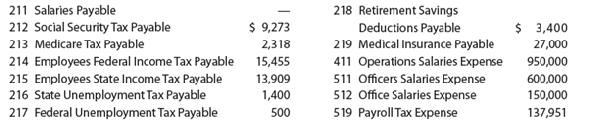

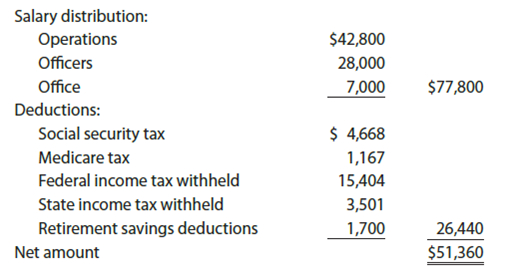

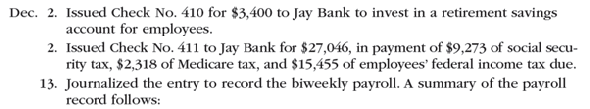

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

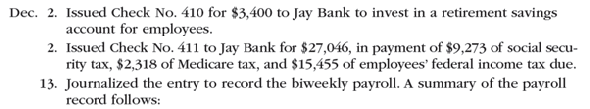

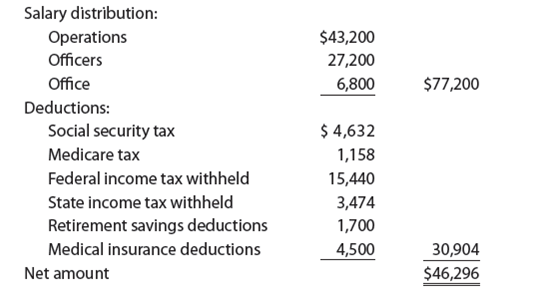

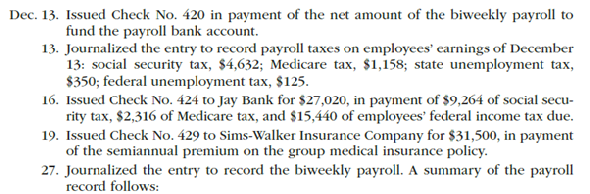

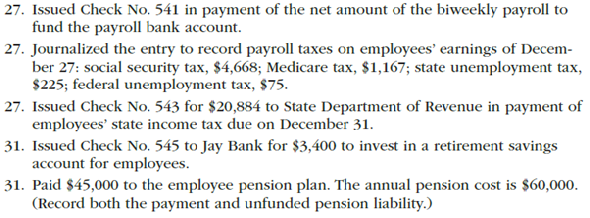

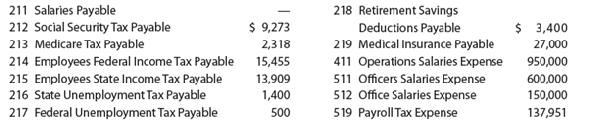

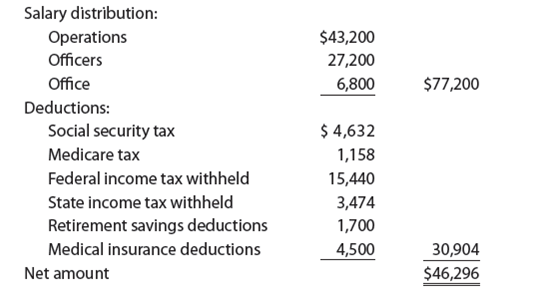

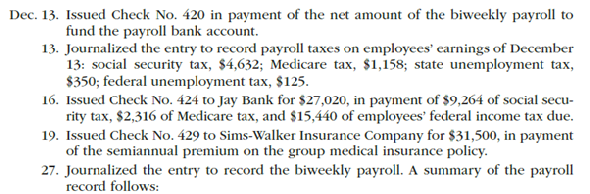

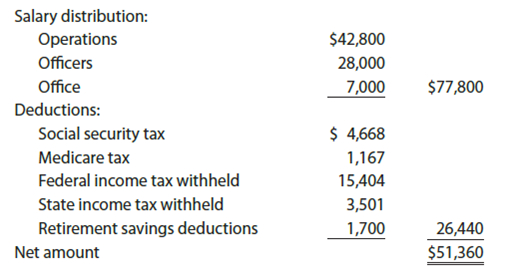

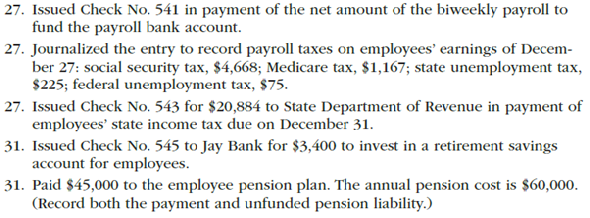

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

Instructions

1. Journalize the transactions.

2. Journalize the following adjusting entries on December 31:

a. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries, $1,400. The payroll taxes are immaterial and are not accrued.

b. Vacation pay, $15,000.

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

Instructions

1. Journalize the transactions.

2. Journalize the following adjusting entries on December 31:

a. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries, $1,400. The payroll taxes are immaterial and are not accrued.

b. Vacation pay, $15,000.

التوضيح

Journal entry forms the basis of an acco...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255